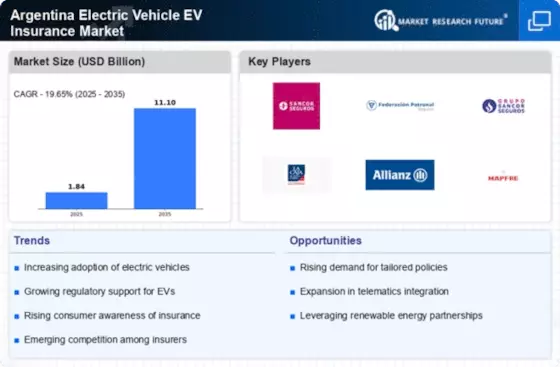

The Electric Vehicle Ev Insurance Market in Argentina is currently characterized by a dynamic competitive landscape, driven by increasing adoption of electric vehicles (EVs) and a growing awareness of

sustainable practices. Key players such as Sancor Seguros (AR), Allianz Argentina (AR), and La Caja de Ahorro y Seguro (AR) are actively positioning themselves to capitalize on these trends. Sancor Seguros (AR) has focused on enhancing its digital platforms to streamline customer engagement, while Allianz Argentina (AR) emphasizes innovative insurance products tailored for EV owners. La Caja de Ahorro y Seguro (AR) is pursuing strategic partnerships with EV manufacturers to offer bundled insurance solutions, thereby enhancing its market presence. Collectively, these strategies indicate a shift towards customer-centric offerings and technological integration, shaping a competitive environment that prioritizes innovation and service quality.

In terms of business tactics, companies are increasingly localizing their operations to better serve the Argentine market. This includes optimizing

supply chains to reduce costs and improve service delivery. The market appears moderately fragmented, with several players vying for market share, yet the influence of major companies is palpable. Their collective actions are likely to set benchmarks for service standards and product offerings, thereby influencing smaller competitors and new entrants.

In December 2025, Allianz Argentina (AR) launched a new insurance product specifically designed for electric vehicles, which includes coverage for battery replacement and charging station access. This strategic move is significant as it addresses the unique concerns of EV owners, potentially attracting a broader customer base and enhancing customer loyalty. By focusing on the specific needs of EV users, Allianz Argentina (AR) positions itself as a leader in this niche market.

In November 2025, Sancor Seguros (AR) announced a partnership with a leading EV manufacturer to provide exclusive insurance packages for new EV buyers. This collaboration is strategically important as it not only expands Sancor's market reach but also aligns the company with the growing trend of sustainable transportation. Such partnerships may enhance brand visibility and customer trust, which are crucial in a competitive landscape.

In October 2025, La Caja de Ahorro y Seguro (AR) implemented an AI-driven claims processing system aimed at improving efficiency and customer satisfaction. This technological advancement is indicative of a broader trend towards digitalization within the industry. By leveraging AI, La Caja de Ahorro y Seguro (AR) can streamline operations, reduce processing times, and enhance the overall customer experience, which is increasingly becoming a competitive differentiator.

As of January 2026, the competitive trends in the Electric Vehicle Ev Insurance Market are heavily influenced by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing service offerings and market reach. Looking ahead, it appears that competitive differentiation will increasingly hinge on innovation and technological advancements rather than solely on pricing strategies. The emphasis on reliable supply chains and customer-centric solutions is likely to define the future landscape of this evolving market.