Expansion of Mobile and IoT Technologies

The proliferation of mobile devices and Internet of Things (IoT) technologies is driving the growth of the location analytics market in Argentina. As mobile penetration continues to rise, businesses are increasingly utilizing location data to enhance customer experiences and optimize operations. In 2025, it is projected that mobile location-based services will account for over 30% of the overall market share. This trend is particularly relevant in sectors such as retail, where businesses leverage location analytics to deliver personalized marketing campaigns and improve customer engagement. Furthermore, the integration of IoT devices enables real-time data collection and analysis, providing organizations with actionable insights. As a result, the location analytics market is likely to see a significant uptick in demand as companies seek to capitalize on the opportunities presented by mobile and IoT technologies.

Rising Demand for Data-Driven Decision Making

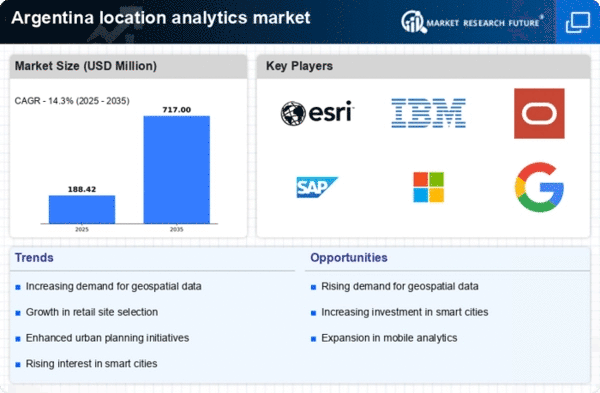

The location analytics market in Argentina is experiencing a notable surge in demand for data-driven decision making across various sectors. Organizations are increasingly recognizing the value of location-based insights to enhance operational efficiency and customer engagement. In 2025, it is estimated that the market will grow by approximately 15%, driven by the need for businesses to leverage geographic data for strategic planning. This trend is particularly evident in retail and logistics, where companies utilize location analytics to optimize supply chains and improve service delivery. The ability to visualize data geographically allows organizations to identify trends and patterns that may not be apparent through traditional analytics, thereby fostering a more informed decision-making process. As a result, the location analytics market is poised for substantial growth as businesses seek to harness the power of location intelligence.

Increased Focus on Urban Planning and Development

The location analytics market in Argentina is being propelled by an increased focus on urban planning and development. As cities continue to grow, there is a pressing need for effective planning tools that can analyze spatial data to inform decision-making. In 2025, it is projected that investments in urban development projects will exceed $1 billion, creating a substantial demand for location analytics solutions. These tools enable planners to visualize demographic trends, assess infrastructure needs, and optimize land use. Moreover, the integration of location analytics into urban planning processes can lead to more sustainable development practices. As municipalities and private developers seek to create livable urban environments, the location analytics market is likely to experience robust growth, driven by the necessity for data-driven insights in planning and development.

Growing Importance of Location Intelligence in Marketing

The increasing importance of location intelligence in marketing strategies is a key driver for the location analytics market in Argentina. Businesses are recognizing that understanding customer behavior in relation to geographic locations can lead to more effective marketing campaigns. By 2025, it is anticipated that location-based marketing will represent a substantial portion of overall marketing expenditures, with companies investing heavily in analytics tools to gain insights into consumer preferences. This trend is particularly pronounced in the retail and hospitality sectors, where targeted promotions based on location can significantly enhance customer engagement. As organizations strive to create personalized experiences, the demand for location analytics solutions is expected to rise, thereby propelling market growth. The ability to analyze and interpret location data will likely become a critical component of successful marketing strategies.

Government Initiatives Supporting Location-Based Services

In Argentina, government initiatives aimed at enhancing location-based services are significantly impacting the location analytics market. The government is investing in infrastructure development and smart city projects, which are expected to create a favorable environment for location analytics solutions. For instance, the implementation of advanced transportation systems and urban planning initiatives is likely to require robust location data analysis. By 2025, public sector investments in these areas could reach upwards of $500 million, thereby stimulating demand for location analytics tools. These initiatives not only improve public services but also encourage private sector participation, leading to a more integrated approach to urban development. Consequently, the location analytics market is likely to benefit from increased collaboration between government entities and private companies, fostering innovation and growth.