Expansion of Mobile Applications

The proliferation of mobile applications in Argentina significantly influences the location as-a-service market. As smartphone penetration continues to rise, businesses are leveraging mobile apps to provide location-based services to consumers. This trend is particularly evident in sectors such as transportation and tourism, where apps facilitate navigation and enhance user experiences. The mobile application market in Argentina is expected to reach a valuation of $1 billion by 2026, indicating a robust growth trajectory. Consequently, the integration of location services within these applications is likely to drive the demand for location as-a-service solutions, further solidifying its position in the market.

Increased Focus on Supply Chain Optimization

The location as-a-service market is significantly impacted by the growing emphasis on supply chain optimization. Companies are increasingly adopting location-based solutions to enhance logistics and distribution processes. By utilizing geolocation data, businesses can track shipments in real-time, reduce delivery times, and improve overall supply chain efficiency. Recent studies indicate that companies implementing location-based logistics solutions can achieve cost savings of up to 20%. This focus on optimizing supply chains is likely to drive the demand for location as-a-service offerings, as organizations seek to leverage technology for competitive advantage.

Rising Demand for Real-Time Location Services

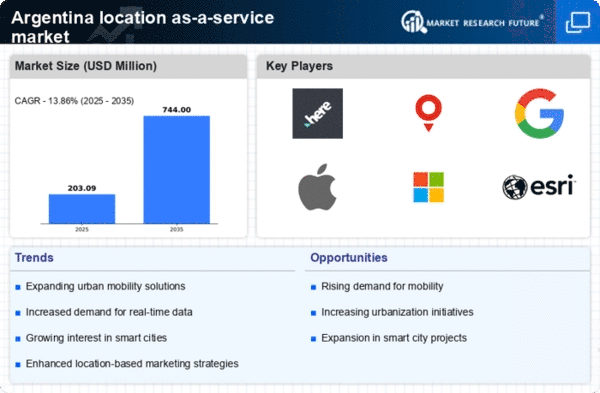

The location as-a-service market experiences a notable surge in demand for real-time location services. Businesses across various sectors, including retail and logistics, increasingly rely on accurate geolocation data to enhance operational efficiency. For instance, the retail sector utilizes location data to optimize inventory management and improve customer experiences. According to recent estimates, the market for real-time location services in Argentina is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for businesses to make data-driven decisions and improve service delivery, thereby propelling the location as-a-service market forward.

Emergence of Location-Based Marketing Strategies

The rise of location-based marketing strategies in Argentina is a key driver for the location as-a-service market. Businesses are increasingly utilizing geolocation data to target consumers with personalized marketing campaigns based on their location. This approach not only enhances customer engagement but also improves conversion rates. Recent data suggests that location-based marketing can increase customer response rates by up to 30%. As more companies recognize the value of targeted marketing, the demand for location as-a-service solutions is expected to grow, thereby contributing to the overall expansion of the market.

Government Initiatives Supporting Digital Transformation

Government initiatives aimed at promoting digital transformation in Argentina play a crucial role in shaping the location as-a-service market. Policies that encourage the adoption of smart technologies and digital infrastructure are fostering an environment conducive to innovation. For example, the Argentine government has launched various programs to support the development of smart cities, which inherently rely on location-based services for efficient urban management. As a result, investments in digital infrastructure are expected to increase, potentially reaching $500 million by 2027. This supportive regulatory framework is likely to enhance the growth prospects of the location as-a-service market.