Market Trends

Key Emerging Trends in the Aromatic Ketone Polymer Market

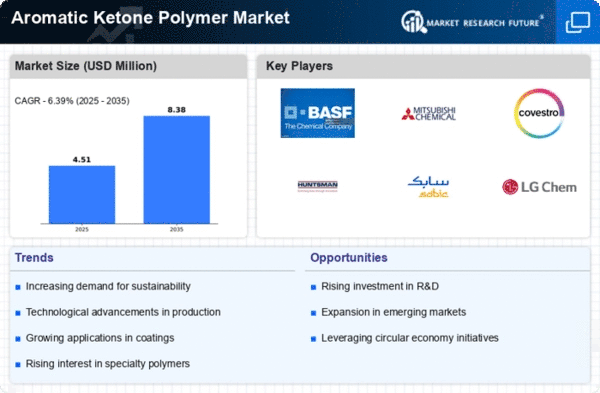

The Aromatic Ketone Polymer market has been witnessing significant trends that are shaping its trajectory in recent times. Aromatic Ketone Polymers, known for their high-temperature stability, mechanical strength, and chemical resistance, have found extensive applications in various industries, including automotive, aerospace, electronics, and healthcare. One noteworthy trend is the increasing demand for high-performance materials in these sectors, driven by the need for lightweight and durable components. As manufacturers seek materials that can withstand harsh operating conditions, Aromatic Ketone Polymers have gained prominence for their ability to deliver exceptional performance under extreme temperatures and aggressive environments.

Moreover, environmental considerations and sustainability have become key influencers in the market trends of Aromatic Ketone Polymers. As the global focus on reducing carbon footprints intensifies, industries are gradually shifting towards eco-friendly and recyclable materials. Aromatic Ketone Polymers, with their inherent stability and longevity, contribute to sustainability goals by extending the lifespan of products and reducing the need for frequent replacements. This has led to an increased preference for these polymers, especially in industries where longevity and environmental impact are critical factors.

In addition to their physical properties, the versatility of Aromatic Ketone Polymers is another factor driving market trends. The adaptability of these polymers to various manufacturing processes, including injection molding and extrusion, makes them suitable for a wide range of applications. This versatility enhances their appeal across different industries, allowing manufacturers to explore new possibilities and innovate in product design. As a result, the Aromatic Ketone Polymer market is experiencing a surge in research and development activities aimed at discovering novel applications and optimizing existing processes.

The aerospace industry stands out as a significant contributor to the growth of the Aromatic Ketone Polymer market. With a constant emphasis on reducing the weight of aircraft components to improve fuel efficiency, Aromatic Ketone Polymers have become preferred materials for manufacturing lightweight and high-strength structural parts. The demand for these polymers in the aerospace sector is expected to continue growing as the industry explores advanced materials for next-generation aircraft.

Furthermore, the automotive industry is increasingly incorporating Aromatic Ketone Polymers into vehicle components to meet stringent regulatory standards and enhance overall performance. As electric vehicles gain traction, the need for lightweight materials becomes even more critical to extend the range and efficiency of batteries. Aromatic Ketone Polymers, with their unique combination of properties, address these requirements and contribute to the ongoing evolution of the automotive sector.

The Aromatic Ketone Polymer market is witnessing dynamic trends driven by the demand for high-performance materials, sustainability considerations, and the versatility of these polymers. As industries continue to prioritize efficiency, longevity, and environmental impact, Aromatic Ketone Polymers are expected to play a pivotal role in shaping the future of various sectors. Manufacturers and researchers alike are likely to explore new avenues and applications for these polymers, ensuring their continued relevance in a rapidly evolving market landscape.

Leave a Comment