China : Leading in Innovation and Adoption

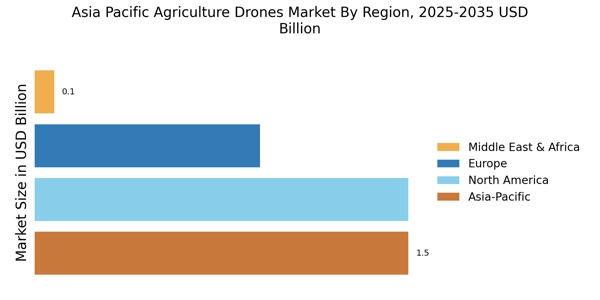

China holds a commanding market share of 63.8% in the APAC agricultural drone sector, valued at $950.0 million. Key growth drivers include rapid technological advancements, increasing demand for precision agriculture, and supportive government policies promoting drone usage in farming. The Chinese government has implemented initiatives to enhance agricultural productivity, alongside investments in infrastructure that facilitate drone operations, such as improved air traffic management systems.

Key markets include provinces like Shandong, Henan, and Jiangsu, where agriculture is a primary economic driver. The competitive landscape features major players like DJI and senseFly, which dominate the market with innovative products. Local dynamics are characterized by a growing acceptance of drone technology in crop monitoring, pest control, and precision spraying, making China a hub for agricultural drone applications.

India : Growth Driven by Agriculture Needs

India's agricultural drone market is valued at $500.0 million, accounting for 33.3% of the APAC market share. The growth is fueled by the need for efficient farming practices, rising labor costs, and government initiatives like the 'Drone Policy 2021' that promote drone usage in agriculture. Increasing awareness of precision farming techniques is driving demand, alongside favorable weather conditions that support crop yields.

Key states such as Punjab, Haryana, and Maharashtra are pivotal markets for agricultural drones. The competitive landscape includes players like DJI and AgEagle Aerial Systems, which are gaining traction. The business environment is evolving, with local startups emerging to cater to specific agricultural needs, focusing on applications like crop health monitoring and soil analysis, thus enhancing productivity in the sector.

Japan : Precision Agriculture Takes Center Stage

Japan's agricultural drone market is valued at $300.0 million, representing 20% of the APAC market share. The growth is driven by the country's focus on technological innovation and the need for efficient agricultural practices due to a declining workforce. Government initiatives, such as subsidies for drone purchases, are encouraging adoption, while advancements in drone technology enhance operational efficiency in farming.

Key regions include Hokkaido and Kumamoto, where agriculture is significant. Major players like Yamaha and Parrot are well-established, contributing to a competitive landscape. The local market dynamics favor precision agriculture applications, including crop monitoring and pesticide spraying, which are increasingly adopted by farmers seeking to optimize yields and reduce costs.

South Korea : Government Support Fuels Growth

South Korea's agricultural drone market is valued at $200.0 million, capturing 13.3% of the APAC market share. The growth is propelled by government support through initiatives aimed at modernizing agriculture and enhancing food security. Increasing demand for precision farming and the adoption of smart farming technologies are also key drivers, alongside favorable regulatory frameworks that facilitate drone operations.

Key regions include Jeollanam-do and Gyeonggi-do, where agricultural activities are concentrated. The competitive landscape features players like DJI and local startups, which are innovating to meet specific agricultural needs. The business environment is conducive to growth, with applications in crop monitoring, soil analysis, and pest management becoming increasingly popular among farmers seeking efficiency and sustainability.

Malaysia : Agricultural Modernization in Progress

Malaysia's agricultural drone market is valued at $100.0 million, accounting for 6.7% of the APAC market share. The growth is driven by the government's push for agricultural modernization and the increasing need for efficient farming solutions. Initiatives like the National Agro-Food Policy are promoting the adoption of technology in agriculture, including drones for crop management and monitoring.

Key states such as Selangor and Penang are emerging as significant markets for agricultural drones. The competitive landscape includes both international players like DJI and local companies. The business environment is evolving, with applications in precision agriculture gaining traction, particularly in palm oil and rice cultivation, enhancing productivity and sustainability in these sectors.

Thailand : Focus on Sustainable Agriculture

Thailand's agricultural drone market is valued at $80.0 million, representing 5.3% of the APAC market share. The growth is driven by increasing awareness of sustainable farming practices and the need for efficient crop management solutions. Government initiatives aimed at promoting technology in agriculture are also contributing to market expansion, alongside rising demand for precision agriculture techniques.

Key regions include Chiang Mai and Nakhon Ratchasima, where agricultural activities are prevalent. The competitive landscape features both local and international players, with companies like DJI leading the market. The business environment is supportive of innovation, with applications in crop monitoring and pest control becoming increasingly popular among farmers looking to enhance yields and reduce environmental impact.

Indonesia : Drones for Efficient Farming

Indonesia's agricultural drone market is valued at $70.0 million, accounting for 4.7% of the APAC market share. The growth is driven by the need for improved agricultural productivity and the government's focus on modernizing the agricultural sector. Initiatives promoting technology adoption in farming are encouraging the use of drones for crop monitoring and management, addressing challenges like labor shortages and inefficiencies.

Key regions include West Java and Central Java, where agriculture is a major economic activity. The competitive landscape includes both local startups and international players like DJI. The business environment is evolving, with applications in precision agriculture gaining traction, particularly in rice and palm oil cultivation, enhancing overall productivity and sustainability in the sector.

Rest of APAC : Varied Adoption Across Regions

The Rest of APAC agricultural drone market is valued at $24.95 million, representing a small but growing segment of the overall market. The growth is driven by increasing awareness of drone technology and its applications in agriculture, alongside government initiatives aimed at promoting agricultural efficiency. Varied regulatory environments and infrastructure development levels across countries influence market dynamics.

Key markets include emerging economies in Southeast Asia and the Pacific Islands, where agricultural practices are evolving. The competitive landscape is diverse, with local players and international companies vying for market share. Applications in crop monitoring and precision agriculture are gaining traction, as farmers seek innovative solutions to enhance productivity and sustainability in their operations.