Market Share

Asia Pacific Energy Storage Market Share Analysis

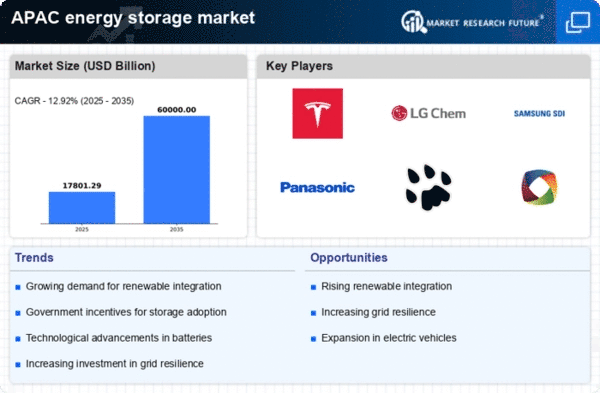

The Asia Pacific energy storage market has been experiencing significant growth and evolving market trends in recent years. As the region continues to witness rapid industrialization and urbanization, the demand for reliable and sustainable energy solutions has escalated. One prominent trend shaping the energy storage landscape in Asia Pacific is the increasing adoption of renewable energy sources, such as solar and wind power. Governments across the region are focusing on clean energy initiatives, driving the need for efficient energy storage systems to address the intermittent nature of renewable sources.

Another notable trend is the surge in electric vehicle (EV) adoption, particularly in densely populated urban areas. The growing awareness of environmental sustainability and the push towards reducing carbon emissions have fueled the demand for EVs. This, in turn, has created a parallel demand for advanced energy storage solutions to power these vehicles efficiently and support the development of robust charging infrastructure. Market players are responding to this trend by innovating battery technologies and energy storage systems tailored for the automotive sector.

Furthermore, there is an increasing emphasis on grid modernization and energy security in the Asia Pacific region. With the rise in energy consumption, grid operators are seeking ways to enhance the reliability and resilience of their grids. Energy storage technologies, such as advanced batteries and pumped hydro storage, are being deployed to balance supply and demand, manage peak loads, and ensure a stable and secure power supply. Governments are incentivizing grid-scale energy storage projects to promote grid stability and reduce the risk of power outages.

The energy storage market in Asia Pacific is also witnessing a shift towards decentralized energy systems. As technology advances and becomes more affordable, businesses and consumers are exploring distributed energy resources, including rooftop solar panels and home energy storage solutions. This decentralization trend aligns with the broader push towards energy democratization, giving individuals and businesses greater control over their energy production and consumption.

Moreover, advancements in energy storage technologies are contributing to increased energy efficiency and cost-effectiveness. Lithium-ion batteries, in particular, have seen substantial improvements in performance and cost reduction, making them more accessible for various applications. The declining costs of energy storage systems are driving their widespread adoption across industries, further boosting market growth.

The regulatory landscape is playing a pivotal role in shaping the energy storage market in Asia Pacific. Governments are formulating policies and regulations to support the integration of energy storage technologies into the existing energy infrastructure. Incentives, subsidies, and favorable regulations are encouraging investments in the sector and fostering innovation. Regional collaborations and partnerships are also becoming more prevalent as countries work together to share best practices and accelerate the development of the energy storage market.

Challenges, however, exist in the form of intermittent policy frameworks and the need for standardization across the region. Harmonizing regulations and standards can facilitate smoother cross-border collaboration and enhance the interoperability of energy storage systems. Additionally, addressing environmental concerns related to the disposal of used batteries and ensuring the sustainability of the entire energy storage lifecycle are critical aspects that need attention.

In conclusion, the Asia Pacific energy storage market is undergoing a dynamic transformation driven by the increasing demand for clean energy, the rise of electric vehicles, grid modernization efforts, and advancements in technology. As the region continues to navigate these market trends, collaboration among governments, industry players, and other stakeholders will be crucial to ensuring a sustainable and resilient energy future for the Asia Pacific region.

Leave a Comment