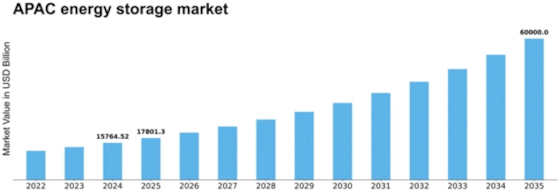

Asia Pacific Energy Storage Size

Asia Pacific Energy Storage Market Growth Projections and Opportunities

The Asia Pacific energy storage market has undergone a significant transformation in recent years, driven by a confluence of factors that shape its dynamic landscape. As the demand for clean and sustainable energy continues to escalate in the region, the market dynamics are experiencing a notable shift.

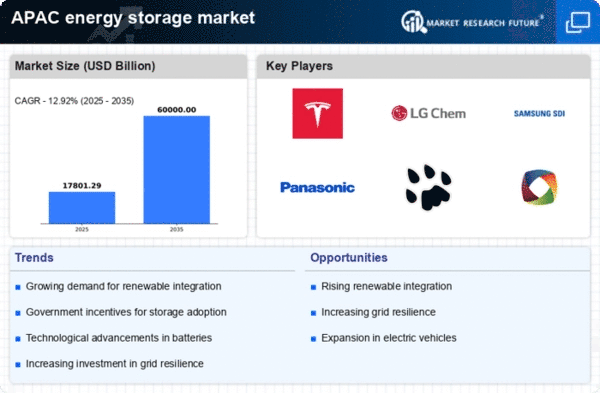

One of the key driving forces behind the growth of the Asia Pacific energy storage market is the increasing emphasis on renewable energy sources. Countries across the region are actively investing in solar, wind, and other green technologies to meet their growing energy needs while addressing environmental concerns. This transition towards cleaner energy sources has propelled the demand for energy storage solutions, such as batteries, to effectively harness and store intermittent renewable energy.

The evolving regulatory landscape also plays a pivotal role in shaping market dynamics. Governments in the Asia Pacific region are introducing policies and incentives to encourage the adoption of energy storage systems. These initiatives aim to create a conducive environment for the integration of renewable energy into the existing power infrastructure, ensuring grid stability and reliability. The regulatory support acts as a catalyst, driving both investments and innovations in the energy storage sector.

Furthermore, the Asia Pacific energy storage market is witnessing a surge in technological advancements. Advances in battery technologies, in particular, have led to increased energy density, longer cycle life, and reduced costs. Lithium-ion batteries, in particular, have emerged as a dominant technology, finding extensive applications in various sectors, from residential to industrial. The constant innovation and improvements in energy storage technologies contribute to the overall market dynamism, fostering competition and efficiency.

In addition to technological advancements, the market dynamics are influenced by the changing energy consumption patterns in the Asia Pacific region. Rapid urbanization and industrialization have led to an escalating demand for power. Energy storage systems offer a solution to address peak demand, ensuring a reliable and stable power supply. As industries and urban centers continue to grow, the need for effective energy storage solutions becomes paramount, creating opportunities for market players to cater to diverse applications.

The interplay between market players also shapes the dynamics of the Asia Pacific energy storage market. The region has witnessed increased collaboration and partnerships between energy storage companies, utilities, and technology providers. These collaborations aim to leverage the strengths of each participant, fostering innovation and expanding the reach of energy storage solutions. Strategic alliances and joint ventures contribute to a more robust and competitive market landscape, allowing for the efficient deployment of energy storage technologies.

However, challenges exist in the form of economic uncertainties, geopolitical tensions, and supply chain disruptions. The global energy landscape is interconnected, and events in one part of the world can have a cascading impact on the Asia Pacific energy storage market. Mitigating these challenges requires a holistic approach, with stakeholders working together to build resilient and adaptable energy storage systems.

In conclusion, the Asia Pacific energy storage market is undergoing dynamic changes driven by the transition towards cleaner energy sources, supportive regulatory frameworks, technological innovations, changing consumption patterns, and collaborative efforts among market players. These factors create a dynamic and evolving landscape, offering opportunities for growth and advancements in the energy storage sector. As the region continues to prioritize sustainable and resilient energy solutions, the market dynamics are likely to shape the future trajectory of the Asia Pacific energy storage market.

Leave a Comment