China : Unmatched Growth and Demand Trends

China holds a commanding 5.5% market share in the APAC probiotics sector, driven by increasing health awareness and a growing middle class. The demand for functional foods, particularly yogurt and dietary supplements, is surging. Government initiatives promoting gut health and stringent regulations on food safety are further propelling market growth. Infrastructure improvements in logistics and distribution are enhancing product availability across urban and rural areas.

India : Health Consciousness Fuels Growth

India's probiotics market is valued at 3.2%, reflecting a robust growth trajectory. The rise in health consciousness among consumers, coupled with increasing disposable incomes, is driving demand for probiotic-rich foods. Regulatory support for health claims on food products is fostering innovation. The burgeoning e-commerce sector is also facilitating access to a variety of probiotic products, enhancing consumer choice.

Japan : Cultural Acceptance Drives Consumption

Japan's probiotics market, valued at 2.8%, is characterized by a strong cultural acceptance of fermented foods. The demand for functional beverages and dairy products is on the rise, supported by aging demographics seeking health benefits. Regulatory frameworks encourage research and development in probiotics, while local production capabilities ensure high-quality offerings. The market is also witnessing a shift towards plant-based probiotics.

South Korea : Strong Market for Functional Foods

South Korea's probiotics market holds a 1.8% share, driven by a strong consumer preference for health-enhancing products. The popularity of fermented foods like kimchi and yogurt is significant, with increasing interest in gut health. Government initiatives promoting probiotics in dietary guidelines are enhancing market visibility. The competitive landscape features both local and international players, ensuring diverse product offerings.

Malaysia : Health Trends Shape Consumer Choices

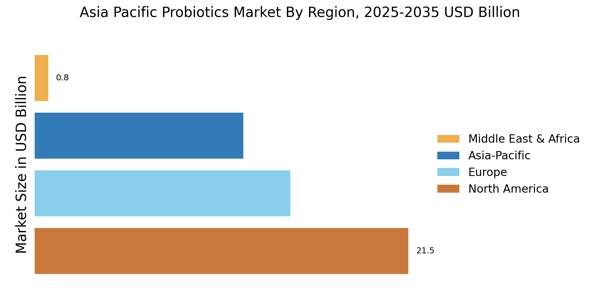

Malaysia's probiotics market, valued at 0.8%, is emerging as a key player in the APAC region. The growing awareness of health benefits associated with probiotics is driving demand, particularly among urban populations. Regulatory support for health claims is fostering innovation in product development. The market is characterized by a mix of local and international brands, with increasing penetration in retail and online channels.

Thailand : Cultural Shift Towards Health Products

Thailand's probiotics market, at 0.7%, is witnessing a cultural shift towards health-oriented products. The demand for functional foods is rising, driven by increasing health awareness and lifestyle changes. Government initiatives promoting healthy eating habits are supporting market growth. Key urban centers like Bangkok are pivotal markets, with a competitive landscape featuring both local and global brands.

Indonesia : Probiotics Market on the Rise

Indonesia's probiotics market, valued at 0.5%, is on an upward trajectory as consumer awareness of gut health increases. The demand for dairy products and supplements is growing, supported by a young population. Regulatory frameworks are evolving to accommodate health claims, enhancing market potential. Major cities like Jakarta are key markets, with a competitive landscape that includes both local and international players.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC, with a market share of 0.24%, showcases diverse trends in probiotics consumption. Each country exhibits unique preferences and regulatory environments, influencing market dynamics. The growth is driven by increasing health awareness and the popularity of functional foods. Local players are adapting to regional tastes, while international brands are exploring market entry strategies to capitalize on emerging opportunities.