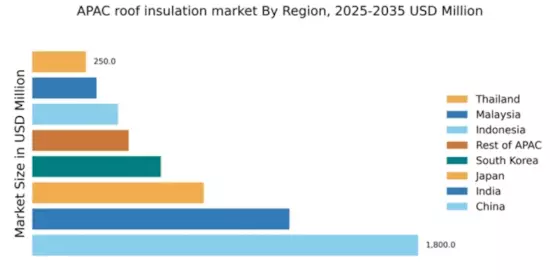

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 40% in the APAC roof insulation sector, valued at $1800.0 million. Key growth drivers include rapid urbanization, increasing energy efficiency regulations, and a booming construction industry. The government has implemented initiatives like the Green Building Action Plan, promoting sustainable building practices. Infrastructure development, particularly in megacities like Beijing and Shanghai, further fuels demand for advanced insulation solutions.

India : Strong Demand from Construction Sector

India's roof insulation market is valued at $1200.0 million, accounting for 25% of the APAC share. The growth is driven by urbanization, rising disposable incomes, and government initiatives like the Pradhan Mantri Awas Yojana, which promotes affordable housing. Demand for energy-efficient buildings is increasing, leading to higher consumption of insulation materials across residential and commercial sectors.

Japan : Focus on Sustainability and Technology

Japan's market for roof insulation stands at $800.0 million, representing 17% of the APAC market. The growth is propelled by stringent energy efficiency regulations and a shift towards sustainable building practices. The government supports innovation in insulation technologies, encouraging the use of eco-friendly materials. The demand is particularly strong in urban areas like Tokyo and Osaka, where energy costs are high.

South Korea : Emphasis on Energy Efficiency

South Korea's roof insulation market is valued at $600.0 million, capturing 12% of the APAC share. Key growth drivers include government policies promoting energy efficiency and the increasing adoption of smart building technologies. The market is characterized by high demand in metropolitan areas such as Seoul and Busan, where construction activity is robust. Major players like Owens Corning and Rockwool are actively expanding their presence.

Malaysia : Government Support for Sustainable Practices

Malaysia's roof insulation market is valued at $300.0 million, accounting for 6% of the APAC market. Growth is driven by government initiatives aimed at promoting green building practices and energy efficiency. The demand for insulation materials is rising in urban centers like Kuala Lumpur, where construction projects are on the rise. Local players are increasingly collaborating with international firms to enhance product offerings.

Thailand : Construction Boom Fuels Market Expansion

Thailand's roof insulation market is valued at $250.0 million, representing 5% of the APAC share. The growth is supported by a booming construction sector and government initiatives aimed at improving energy efficiency in buildings. Key markets include Bangkok and Chiang Mai, where urban development is accelerating. The competitive landscape features both local and international players, with a focus on innovative insulation solutions.

Indonesia : Market Potential in Urban Areas

Indonesia's roof insulation market is valued at $400.0 million, capturing 8% of the APAC market. The growth is driven by increasing awareness of energy efficiency and government policies promoting sustainable construction. Key cities like Jakarta and Surabaya are witnessing a surge in demand for insulation materials. The market is competitive, with major players like BASF and Knauf Insulation establishing a strong presence.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market for roof insulation is valued at $450.0 million, accounting for 9% of the overall market. Growth varies significantly across countries, influenced by local regulations and construction trends. Emerging markets are increasingly adopting energy-efficient practices, while developed regions focus on innovation. The competitive landscape includes both local and international players, adapting to diverse market needs.