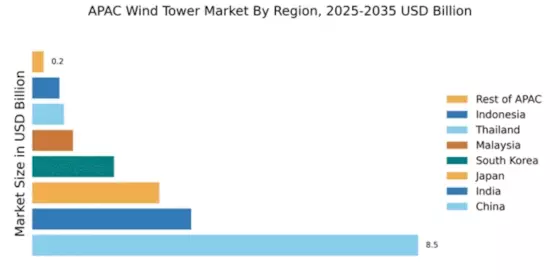

China : Unmatched Growth and Innovation

Key markets include provinces like Inner Mongolia and Xinjiang, which are rich in wind resources. The competitive landscape features major players such as Mingyang Smart Energy and Goldwind, which dominate the local market. The business environment is characterized by rapid technological advancements and a focus on sustainability. Wind energy applications are expanding in sectors like manufacturing and agriculture, making China a pivotal player in The wind tower market.

India : Strong Growth Amidst Challenges

Key states include Tamil Nadu and Gujarat, which are leading in wind energy installations. The competitive landscape features players like Suzlon Energy and GE Renewable Energy, which are actively expanding their footprint. The local market is dynamic, with increasing participation from private players and a focus on innovative technologies. Wind energy is particularly significant in rural electrification and agricultural applications, enhancing its relevance in India's energy mix.

Japan : Innovation Meets Sustainability

Key markets include Hokkaido and Akita, known for their favorable wind conditions. The competitive landscape features major players like Vestas Wind Systems and Siemens Gamesa, which are investing in local partnerships. The business environment is characterized by a focus on technological innovation and sustainability. Wind energy applications are expanding in urban areas, contributing to Japan's energy transition and reducing reliance on fossil fuels.

South Korea : Government Support and Investment

Key regions include Jeju Island and Ulsan, which are pivotal for wind energy development. The competitive landscape features players like Envision Energy and Nordex, which are expanding their operations in the country. The local market dynamics are influenced by a strong focus on innovation and sustainability. Wind energy applications are increasingly relevant in urban infrastructure projects, contributing to South Korea's energy transition goals.

Malaysia : Focus on Sustainable Growth

Key markets include Sabah and Sarawak, which have favorable wind conditions for energy generation. The competitive landscape is emerging, with players like Siemens Gamesa and local firms beginning to establish a presence. The business environment is characterized by a growing interest in sustainable energy solutions. Wind energy applications are particularly relevant in rural electrification and industrial sectors, enhancing its significance in Malaysia's energy landscape.

Thailand : Strategic Investments and Policies

Key regions include Nakhon Ratchasima and Chaiyaphum, which are leading in wind energy installations. The competitive landscape features players like Vestas Wind Systems and local firms, which are actively expanding their footprint. The local market is dynamic, with increasing participation from private players and a focus on innovative technologies. Wind energy is particularly significant in rural electrification and agricultural applications, enhancing its relevance in Thailand's energy mix.

Indonesia : Potential for Future Growth

Key regions include Sulawesi and Nusa Tenggara, which have favorable wind conditions for energy generation. The competitive landscape is emerging, with players like GE Renewable Energy and local firms beginning to establish a presence. The business environment is characterized by a growing interest in sustainable energy solutions. Wind energy applications are particularly relevant in rural electrification and industrial sectors, enhancing its significance in Indonesia's energy landscape.

Rest of APAC : Emerging Markets and Innovations

Key markets include emerging economies like Vietnam and the Philippines, which are beginning to explore wind energy potential. The competitive landscape features a mix of local and international players, including Siemens Gamesa and Nordex, which are actively seeking opportunities in these markets. The local market dynamics are influenced by a strong focus on sustainability and innovation. Wind energy applications are increasingly relevant in rural electrification and industrial sectors, enhancing its significance in the broader APAC region.

.png)