Research Methodology on Asset Performance Management Market

Introduction

The business environment is dynamic and competitive. Managing assets efficiently and cost-effectively is essential to businesses today to remain competitive and efficient. Therefore, asset performance management is a critical element in overall operational effectiveness. Market Research Future (MRFR) has assessed an exhaustive report on the global asset performance management market. This report provides an in-depth analysis of the important trends, market drivers, opportunities, and challenges that are driving the growth of the market and impacting businesses.

Research Methodology

The research report aims to provide a comprehensive analysis of the asset performance management market. To accomplish this, MRFR structured the report by using both primary and secondary data. The data sources incorporate include external, as well as internal sources, available through in-depth interviews, industry forums, and other market research sources.

A) Research Objectives and Scope

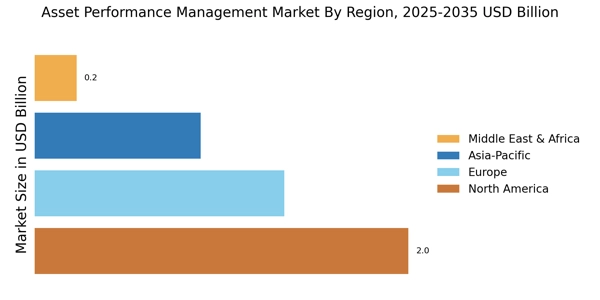

The objective of this research is to understand the current size and structure of the market and forecast its future growth trajectory. The report covers the global asset performance management market in terms of value and volume. It also provides a regional analysis of the market.

1. Secondary Data Collection

MRFR utilized a variety of market research sources, such as annual reports, published reports, databases, and industry forums, to collect secondary data on the global asset performance management market. The secondary research sources are used to understand the market dynamics, trends, and progress in the industry.

2. Primary Data Collection

MRFR has collected primary data through interviews conducted with industry experts and opinion leaders, who have provided valuable insights into the asset performance management market. The primary research is conducted to understand the competitive landscape and recent market trends.

3. Data Analysis and Verification

The data collected is analyzed and verified with tools like IBM SPSS Statistics and Microsoft Excel. The analyzed data was compiled and arranged into tables, graphs, and infographics for better understanding and representation.

C) Data Triangulation

Market data collected from internal and external sources is validated through triangulation methodologies. This involves a combination of data mining, analysis of root sources, and validation of assumptions. This approach enabled the market segments and subsegments to be analyzed in detail for the global asset performance management market.

D) Model Calibration

To assess the performance of the global asset performance management market, MRFR conducted a model calibration by combining the forecasts of a variety of economic and economic regions. The model is then calibrated to determine how each region and segment would impact the overall market performance.

E) Forecasting and Reporting

Based on the verified data and calibrated model, the global asset performance management market is forecasted. The forecasts are done on the factors that impact the market's performance. The validated forecast data is then compiled into a comprehensive report on the global asset performance management market.