Research Methodology on Atopic Dermatitis Market

Research Objectives

The primary objective of this research is to analyse and forecast the market size of the global atopic dermatitis market from 2023 to 2030.

Secondary objectives include

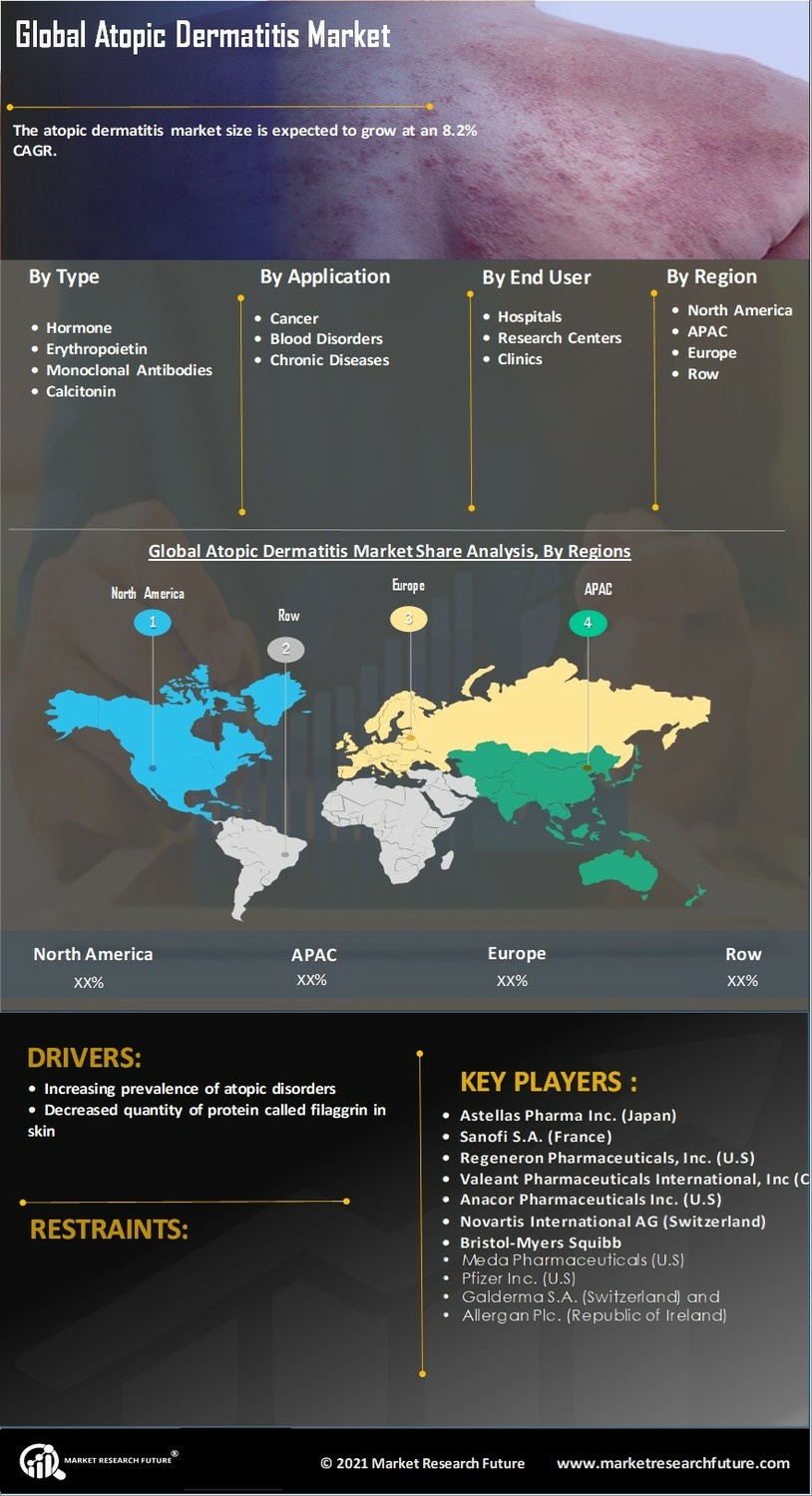

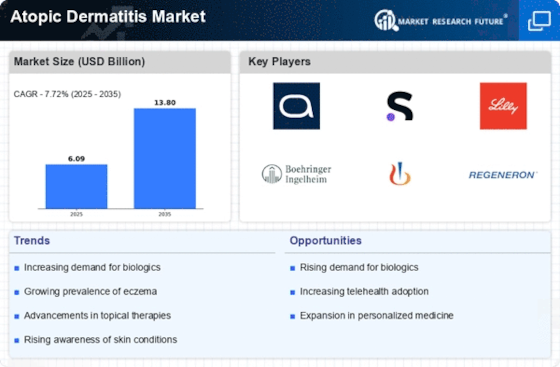

- Comprehensive understanding of the global atopic dermatitis market dynamics and market trends

- Analysing the factors driving the growth of the market and the potential risks associated with the same

- Identification of the recent advancements in the market and the factors restraining its growth

- Analysis of key global market players and their respective strategies

- Identification of the lucrative opportunities in the market

Research Scope

The scope of this research report includes the global atopic dermatitis market size in terms of value. The segmentation of the market is done based on key parameters such as product, ageing group, and region.

- Product: Topical Treatment and Oral Treatments

- Age Group: Paediatric and Adult

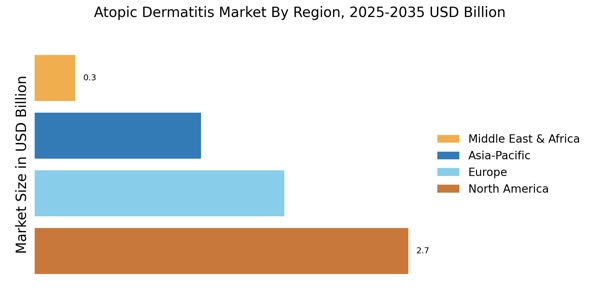

- Region: North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa

Research Design

Research Design plays a crucial role in designing the research methodology. Due to the sensitivity of business objectives, the research design should be chosen to suit the purpose of the research. Thus, for this research report, a descriptive research design is used. This research design enables the investigator to attain an in-depth understanding of the factors propelling the growth of the global atopic dermatitis market.

Research Approach

The research conducted to develop this report will follow a robust approach, thus providing reliable and legitimate information to the readers. The approach to analysing the market dynamics, trends, and market size will include secondary and primary research methodologies.

Primary Research Methodology

Primary research helps the investigator gain an in-depth understanding of the market and its stakeholders. The investigator interacts with key industry players, industry experts, opinion leaders, and market associations for market analysis. The primary research includes in-depth interviews, surveys, and market observations.

Secondary Research Methodology

Secondary research enables the investigator to gain an idea of the existing market trends, industry developments and the competitive landscape prevailing in the market. Secondary research is conducted using sources such as journal articles, whitepapers, government data, industry databases, and other credible sources of information.

Data Collection Approach

For the market analysis, both primary and secondary research methodologies are used. The data gathered through both sources will be analysed and validated to develop the market size of the global atopic dermatitis market. The market size will be calculated based on the top-down approach and the bottom-up approach.

Data Analysis and Validation

The data gathered from the primary and secondary sources are validated using internal and external triangulation techniques. This technique will enable the investigator to understand the market trends, dynamics, and market size accurately. Moreover, all the data analysed will be checked for plausibility, accuracy, and definiteness.

Assumptions

The research conducted for this report will be provided following the assumptions made by the market, industry, and stakeholders.