Market Diversification

The Global ATV Parts and Accessories Market Industry is experiencing diversification as manufacturers expand their product offerings. This includes a wider range of parts and accessories tailored to various ATV models and consumer preferences. By catering to niche markets, such as racing enthusiasts or utility vehicle users, companies can tap into different consumer segments. This diversification strategy not only enhances market reach but also fosters innovation in product development. As a result, the industry is likely to see sustained growth, with an increasing number of options available to consumers, thereby driving sales and enhancing overall market dynamics.

Rising Disposable Income

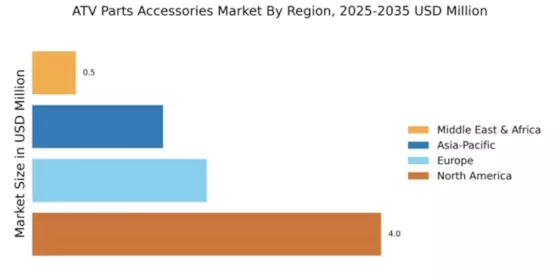

An increase in disposable income among consumers is likely to propel the Global ATV Parts and Accessories Market Industry. As individuals have more financial resources, they are more inclined to invest in recreational vehicles and their enhancements. This trend is particularly evident in emerging markets, where economic growth is leading to a surge in ATV ownership. The ability to purchase high-quality parts and accessories further supports this trend, as consumers seek to personalize their vehicles. Consequently, the market is poised for growth, with a projected compound annual growth rate of 4.31% from 2025 to 2035, indicating a robust future for the industry.

Environmental Regulations

The Global ATV Parts and Accessories Market Industry is also shaped by evolving environmental regulations. Governments worldwide are increasingly implementing stricter emissions standards for off-road vehicles, prompting manufacturers to develop more eco-friendly ATVs. This shift not only influences the design of new vehicles but also drives the demand for parts that comply with these regulations. As consumers become more environmentally conscious, there is a growing preference for sustainable products, including parts made from recycled materials. This trend may lead to a transformation in the market, as companies adapt to meet regulatory requirements while appealing to eco-aware consumers.

Technological Advancements

Technological innovations in ATV design and manufacturing are significantly influencing the Global ATV Parts and Accessories Market Industry. Enhanced features such as improved suspension systems, fuel efficiency, and safety mechanisms attract consumers looking for high-performance vehicles. The integration of smart technologies, including GPS and connectivity features, is also becoming commonplace. These advancements not only enhance the riding experience but also create a demand for compatible parts and accessories. As manufacturers continue to innovate, the market is expected to expand, with projections indicating a growth to 2.49 USD Billion by 2035, driven by consumer preferences for modernized ATVs.

Growing Recreational Activities

The increasing popularity of recreational activities, particularly off-road riding, is a primary driver for the Global ATV Parts and Accessories Market Industry. As more individuals engage in outdoor adventures, the demand for ATVs and their associated parts rises. In 2024, the market is projected to reach 1.56 USD Billion, reflecting a growing consumer base that seeks enhanced performance and customization options. This trend is further supported by the rise of ATV clubs and events, which foster community engagement and promote the use of ATVs for leisure. Such activities not only boost sales but also encourage the purchase of aftermarket parts and accessories.