Technological Innovations

The Auto Back Up Camera Module Market Industry is significantly influenced by rapid technological innovations. Advancements in camera technology, such as higher resolution imaging and improved night vision capabilities, are enhancing the functionality of back up camera systems. These innovations are making it possible for manufacturers to offer more sophisticated products that provide clearer images and better performance in various conditions. Additionally, the integration of features like obstacle detection and real-time alerts is becoming more common, further increasing the appeal of these modules. Market analysis suggests that the introduction of new technologies could lead to a substantial increase in market share for companies that invest in research and development. As technology continues to evolve, the demand for advanced back up camera modules is expected to rise, driving growth in the industry.

Increasing Safety Regulations

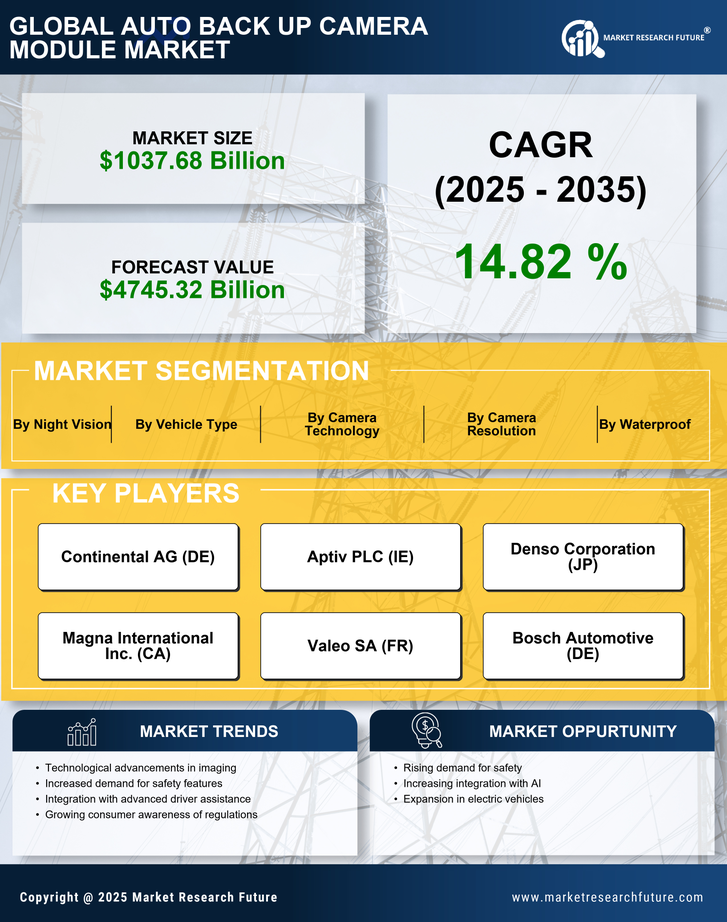

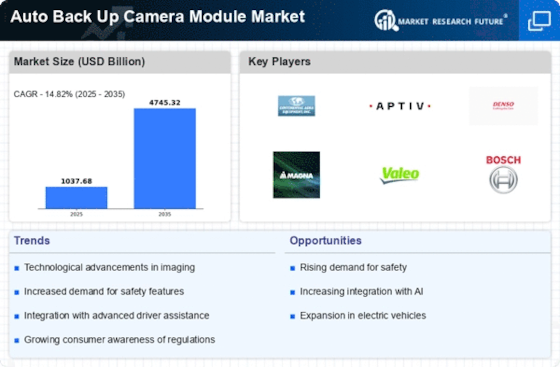

The Auto Back Up Camera Module Market Industry is experiencing a surge in demand due to the implementation of stringent safety regulations across various regions. Governments are mandating the inclusion of rearview cameras in new vehicles to enhance safety and reduce accidents. For instance, regulations in several countries require that all new passenger vehicles be equipped with rearview cameras by a specific date. This regulatory push is likely to drive the market, as manufacturers must comply with these standards to remain competitive. The market for auto back up camera modules is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As safety becomes a priority, the adoption of these modules is expected to rise, further solidifying their importance in the automotive sector.

Growth of the Automotive Sector

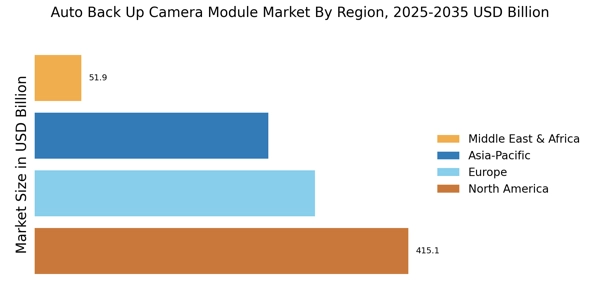

The Auto Back Up Camera Module Market Industry is benefiting from the overall growth of the automotive sector. As vehicle production increases, so does the demand for safety features, including back up cameras. Recent data indicates that global vehicle production is on an upward trajectory, with millions of new vehicles being manufactured each year. This growth is creating a favorable environment for the auto back up camera module market, as manufacturers seek to equip their vehicles with the latest safety technologies. Furthermore, the rise in vehicle sales, particularly in emerging markets, is likely to contribute to the expansion of this market segment. As more consumers purchase new vehicles, the demand for back up camera modules is expected to grow, aligning with the broader trends in the automotive industry.

Rising Awareness of Road Safety

The Auto Back Up Camera Module Market Industry is experiencing growth driven by rising awareness of road safety among consumers and manufacturers alike. As accidents caused by reversing vehicles continue to be a concern, the importance of back up cameras is becoming increasingly recognized. Educational campaigns and advocacy for safer driving practices are contributing to this heightened awareness, prompting consumers to seek vehicles equipped with advanced safety features. Market trends indicate that as awareness increases, so does the willingness to invest in vehicles that offer enhanced safety technologies. This shift in consumer mindset is likely to drive demand for auto back up camera modules, as they are seen as essential components for improving road safety. Consequently, manufacturers are expected to respond by integrating these systems into their vehicle designs, further propelling the market forward.

Consumer Demand for Enhanced Features

The Auto Back Up Camera Module Market Industry is witnessing a notable increase in consumer demand for enhanced vehicle features. As consumers become more aware of the benefits of advanced safety technologies, the desire for vehicles equipped with back up cameras is growing. This trend is particularly evident among younger buyers who prioritize safety and technology in their purchasing decisions. Market data indicates that vehicles with back up camera systems are perceived as more desirable, leading to higher sales figures for manufacturers that incorporate these features. The integration of back up cameras not only improves safety but also adds convenience, appealing to a broader audience. Consequently, this rising consumer expectation is likely to propel the market forward, as automakers strive to meet these demands and differentiate their offerings in a competitive landscape.