Emergence of Mobile Applications

The Auto Collision Estimating Software Market is increasingly influenced by the emergence of mobile applications. These applications provide users with the ability to conduct estimates directly from their smartphones, enhancing convenience and accessibility. As mobile technology continues to advance, the demand for mobile-compatible estimating solutions is likely to rise. Recent surveys indicate that nearly 60% of repair shops are considering mobile applications as a key component of their estimating processes. This trend not only caters to the growing preference for mobile solutions but also aligns with the industry's push for more user-friendly and efficient estimating tools.

Regulatory Compliance and Standards

The Auto Collision Estimating Software Market is significantly impacted by the need for regulatory compliance and adherence to industry standards. As governments and regulatory bodies implement stricter guidelines for vehicle repairs and insurance claims, software solutions must evolve to meet these requirements. This compliance ensures that estimates are accurate and transparent, fostering trust among consumers and insurers. The market is likely to see an increase in demand for software that incorporates these regulatory standards, as failure to comply can result in financial penalties and reputational damage for repair shops. This driver emphasizes the importance of integrating compliance features into estimating software.

Shift Towards Cloud-Based Solutions

The Auto Collision Estimating Software Market is experiencing a significant shift towards cloud-based solutions. This transition allows for greater accessibility and collaboration among stakeholders, including repair shops, insurance companies, and customers. Cloud-based platforms enable real-time updates and data sharing, which can lead to faster claim processing and improved communication. According to recent data, the adoption of cloud solutions in the estimating software sector is expected to increase by approximately 15% annually. This trend reflects a broader movement towards digital transformation in the automotive repair industry, facilitating more efficient workflows and reducing operational costs.

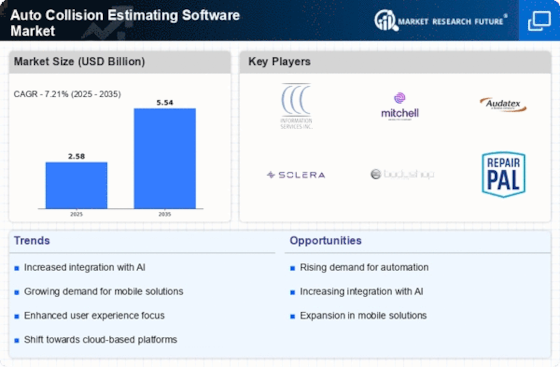

Integration of Advanced Technologies

The Auto Collision Estimating Software Market is witnessing a notable integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the accuracy of damage assessments and streamline the estimating process. For instance, AI algorithms can analyze images of damaged vehicles to provide precise repair estimates, thereby reducing human error. The market is projected to grow as these technologies become more prevalent, with estimates suggesting a compound annual growth rate of around 8% over the next five years. This integration not only improves efficiency but also enhances customer satisfaction by providing quicker and more reliable estimates.

Growing Demand for Enhanced Customer Experience

The Auto Collision Estimating Software Market is driven by the growing demand for enhanced customer experience. Consumers increasingly expect quick, accurate, and transparent estimates during the repair process. Software solutions that prioritize user experience, such as intuitive interfaces and clear communication channels, are becoming essential. Research indicates that businesses that invest in customer-centric estimating software can see a 20% increase in customer satisfaction ratings. This focus on customer experience not only helps repair shops retain clients but also attracts new customers, thereby driving growth in the estimating software market.