Market Share

Automotive Air Flow Meter Market Share Analysis

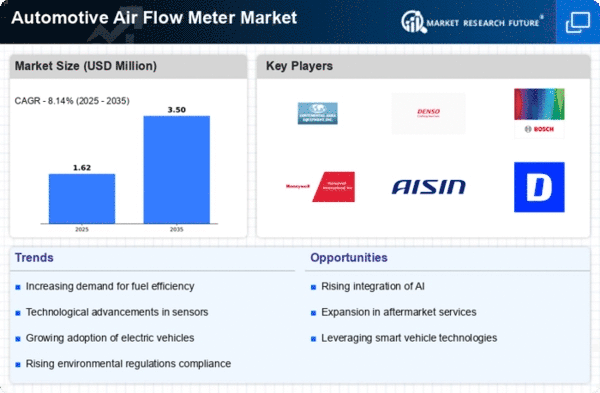

The automotive air flow meter market has been witnessing dynamic shifts in recent years, driven by various market trends that shape the industry's landscape. One notable trend is the growing emphasis on fuel efficiency and emissions reduction in the automotive sector. As governments worldwide tighten regulations to curb pollution and promote sustainable practices, automakers are compelled to adopt technologies that enhance fuel efficiency. This has fueled the demand for advanced air flow meters, which play a crucial role in optimizing the air-to-fuel ratio in combustion engines, thereby improving overall engine efficiency and reducing emissions.

Another significant trend in the automotive air flow meter market is the increasing adoption of electric vehicles (EVs). As the automotive industry undergoes a paradigm shift towards cleaner and greener mobility solutions, EVs have gained substantial traction. Unlike traditional internal combustion engines, electric vehicles rely on precise air flow measurements for efficient battery cooling and optimal performance. Consequently, the demand for air flow meters suitable for electric powertrains has witnessed a noticeable uptick, reflecting the broader transition towards electric mobility.

Moreover, technological advancements have played a pivotal role in shaping the automotive air flow meter market. Innovations in sensor technologies and materials have led to the development of more accurate and reliable air flow meters. Automotive manufacturers are now integrating cutting-edge sensors and digital signal processing techniques to enhance the precision and responsiveness of air flow measurements. This trend is not only contributing to better engine performance but is also opening avenues for the integration of air flow meters with advanced driver assistance systems (ADAS) for more intelligent and adaptive vehicle control.

Globalization and the interconnected nature of economies have also influenced the automotive air flow meter market trends. Automotive manufacturers are increasingly looking for standardized components that can be seamlessly integrated into various vehicle models, irrespective of their geographical location. This demand for standardized air flow meters has driven suppliers to develop versatile and adaptable solutions, fostering a more globally integrated supply chain within the automotive industry.

Furthermore, the aftermarket segment of the automotive air flow meter market has witnessed notable developments. With a growing number of vehicle owners seeking cost-effective solutions for maintaining and upgrading their vehicles, the aftermarket for air flow meters has expanded significantly. This trend is driven by the increasing awareness among consumers about the importance of regular maintenance for optimal vehicle performance and fuel efficiency. As a result, aftermarket suppliers are focusing on providing high-quality, compatible air flow meters that cater to a wide range of vehicle makes and models.

In conclusion, the automotive air flow meter market is undergoing a transformative phase, driven by key trends that underscore the industry's commitment to sustainability, technological innovation, and global integration. The demand for more efficient and precise air flow meters aligns with the broader goals of the automotive sector, including the transition to electric mobility and compliance with stringent emissions standards. As technology continues to evolve, the automotive air flow meter market is poised to play a crucial role in shaping the future of transportation by contributing to cleaner, more efficient, and technologically advanced vehicles.

Leave a Comment