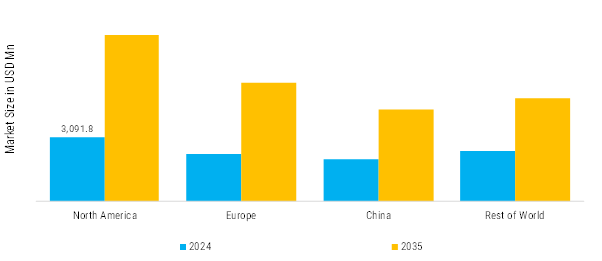

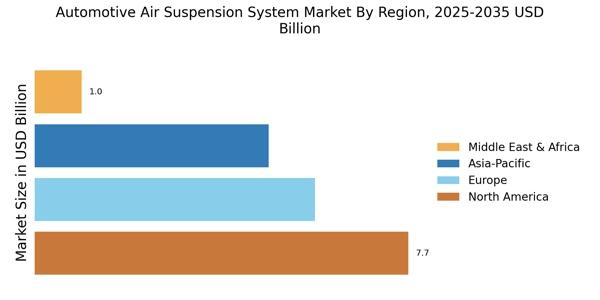

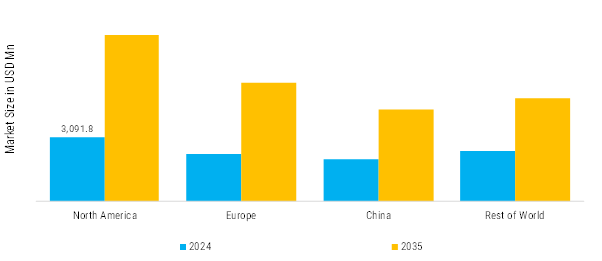

Based on region, the Global Automotive air suspension system (Air Spring+ASU) is segmented into North America, Europe, China and rest of world. North America accounted for the largest market share in 2024 and is anticipated to reach USD 8,060.8 Million by 2035 also is projected to grow at the highest CAGR of 9.1% during the forecast period.

North America: Most Established Market

The North American automotive air suspension system (Air Spring + ASU) industry, spanning the U.S., Canada, and Mexico, is growing steadily as OEMs and aftermarket players meet rising demand for comfort, performance, and efficiency. Air suspension systems are increasingly adopted in passenger cars, SUVs, heavy trucks, buses, and electric vehicles, supported by consumer preference for premium features and stricter safety and efficiency regulations.

In the United States, premium brands such as Tesla, Cadillac, Lincoln, and Jeep integrate advanced air springs with ASUs in models such as the Tesla Model S/X, Lincoln Navigator, and Jeep Grand Cherokee. These vehicles showcase benefits like adaptive ride height, aerodynamic efficiency, and customizable driving modes. Commercial OEMs, including Freightliner and Peterbilt, widely use air suspension in heavy-duty trucks to ensure cargo protection, driver comfort, and long-haul reliability.

In Canada, adoption is driven by demand for rugged SUVs, pickup trucks, and buses suited to harsh weather and long-distance travel. Air suspension helps improve ride stability on icy and uneven terrains, while commercial fleets leverage it for heavy-load stability and cargo safety.

Europe: Most Technological Advanced

The European automotive air suspension system (Air Spring + ASU) industry is one of the most technologically advanced worldwide, driven by the region’s premium vehicle segment, stringent regulations, and leadership in sustainable mobility. Air suspension systems in Europe are widely adopted in passenger cars, SUVs, buses, and heavy-duty trucks to deliver adaptive ride comfort, safety, and efficiency.

In the passenger vehicle market, leading brands such as Mercedes-Benz, BMW, Audi, and Porsche have set benchmarks by equipping luxury sedans and SUVs with advanced electronic air suspension. The Mercedes S-Class and Audi A8 use ASU-controlled air springs to automatically adjust ride height and damping, ensuring comfort while improving aerodynamics at high speeds. Similarly, SUVs like the Porsche Cayenne and BMW X5 offer customizable driving modes, balancing sport performance with luxury-grade smoothness

China: Experiencing Dynamic Growth

The China automotive air suspension system (Air Spring + ASU) industry is experiencing rapid growth, driven by rising demand for passenger comfort, vehicle stability, and advanced mobility solutions. Air suspension systems, integrating air springs with electronic control units, are increasingly adopted across passenger cars, SUVs, commercial vehicles, and electric vehicles. The technology allows vehicles to adapt to varying loads and road conditions, ensuring consistent ride height, improved handling, and enhanced safety.

In the passenger vehicle segment, air suspension supports smoother rides, reduced vibrations, and better noise isolation, aligning with the growing consumer preference for luxury and premium driving experiences. Adjustable ride height and adaptive damping contribute to both comfort and vehicle efficiency, particularly for electric vehicles where weight distribution and aerodynamics are critical for range optimization.

Rest of World: Emerging and Growing

The rest of the world automotive air suspension system (Air Spring + ASU) industry encompasses regions outside North America, Europe, and China, including Asia-Pacific (excluding China), the Middle East, Africa, and South America. This segment is witnessing steady growth driven by increasing demand for comfort, safety, and vehicle adaptability across passenger and commercial vehicles. Air springs combined with electronic control units provide advanced suspension capabilities, such as adjustable ride height, load leveling, and vibration reduction, which enhance driving stability and occupant comfort.