Rising Vehicle Production

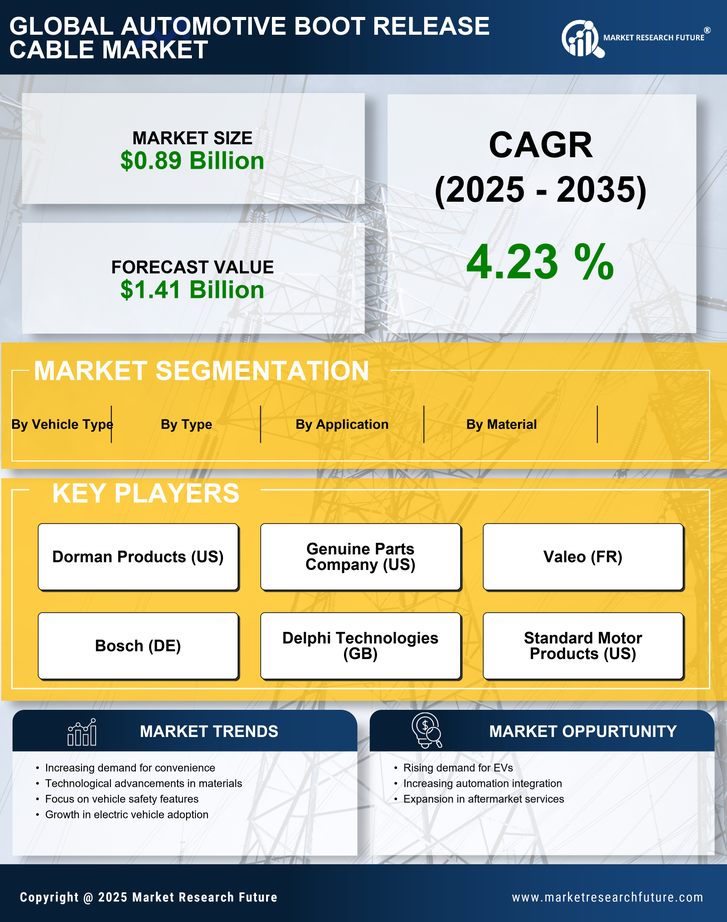

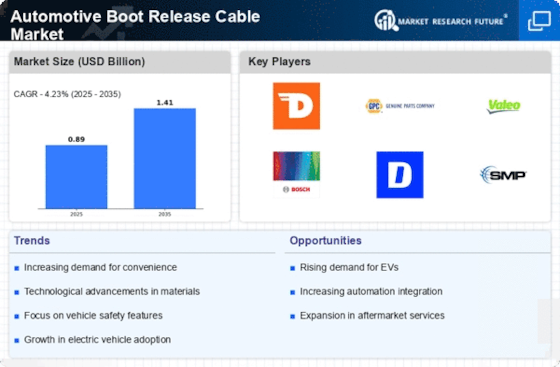

The increasing production of vehicles is a primary driver for the Automotive Boot Release Cable Market. As manufacturers ramp up output to meet consumer demand, the need for various components, including boot release cables, escalates. In 2025, vehicle production is projected to reach approximately 90 million units, reflecting a steady growth trend. This surge in production not only enhances the demand for boot release cables but also encourages manufacturers to innovate and improve the quality of these components. Consequently, the Automotive Boot Release Cable Market is likely to experience significant growth as automakers seek reliable and efficient solutions to enhance vehicle functionality.

Growth of Aftermarket Services

The expansion of aftermarket services is another crucial driver for the Automotive Boot Release Cable Market. As vehicles age, the demand for replacement parts, including boot release cables, increases. The aftermarket segment is expected to grow at a compound annual growth rate of around 5% through 2025. This growth is driven by the rising number of vehicles on the road and the increasing consumer preference for maintaining older vehicles. As a result, the Automotive Boot Release Cable Market is poised to benefit from this trend, as more consumers seek quality replacement parts to ensure the longevity and performance of their vehicles.

Increased Focus on Vehicle Customization

The growing trend of vehicle customization is significantly influencing the Automotive Boot Release Cable Market. Consumers are increasingly seeking personalized features and enhancements for their vehicles, which often includes modifications to boot release mechanisms. This trend is particularly evident in the aftermarket sector, where customized solutions are in high demand. As a result, manufacturers are likely to invest in developing specialized boot release cables that cater to diverse consumer preferences. This shift towards customization not only drives sales but also encourages innovation within the Automotive Boot Release Cable Market, as companies strive to meet the evolving needs of consumers.

Technological Innovations in Cable Design

Technological advancements in cable design and materials are transforming the Automotive Boot Release Cable Market. Innovations such as lightweight materials and enhanced durability are becoming increasingly prevalent, allowing manufacturers to produce more efficient and reliable boot release cables. These advancements are particularly relevant as the automotive industry moves towards more fuel-efficient and environmentally friendly vehicles. The integration of advanced materials is expected to enhance the performance and lifespan of boot release cables, thereby driving demand within the market. As manufacturers adopt these technologies, the Automotive Boot Release Cable Market is likely to witness a shift towards higher quality and more sustainable products.

Regulatory Compliance and Safety Standards

The stringent regulatory compliance and safety standards imposed on the automotive industry are pivotal drivers for the Automotive Boot Release Cable Market. As governments worldwide implement more rigorous safety regulations, manufacturers are compelled to ensure that their components, including boot release cables, meet these standards. This compliance not only enhances vehicle safety but also boosts consumer confidence in automotive products. The increasing emphasis on safety features is expected to drive demand for high-quality boot release cables that adhere to these regulations. Consequently, the Automotive Boot Release Cable Market is likely to experience growth as manufacturers prioritize safety and compliance in their product offerings.