Rising Demand for Electric Vehicles

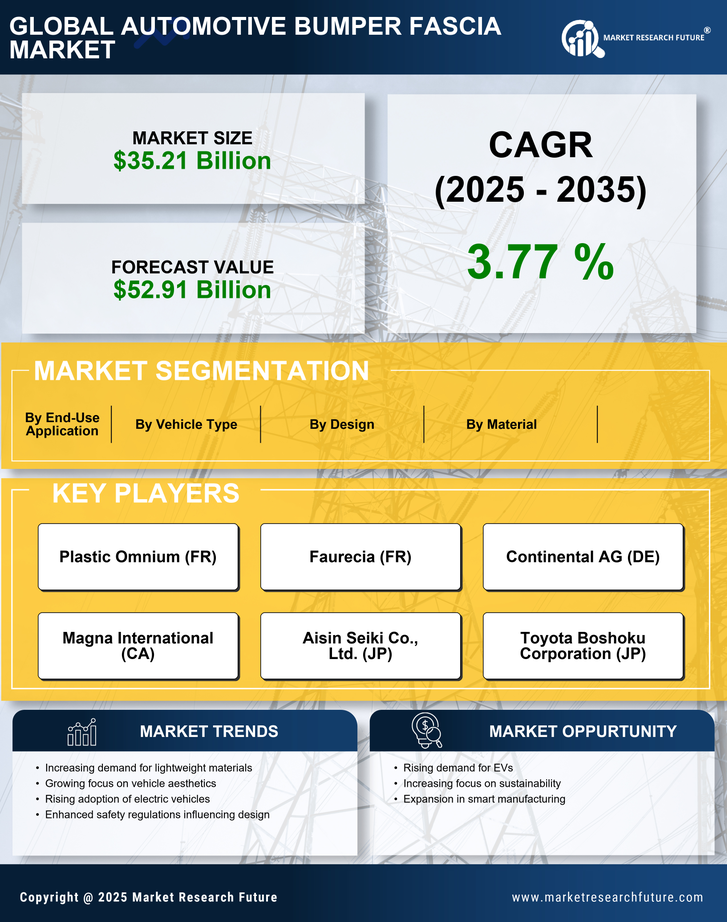

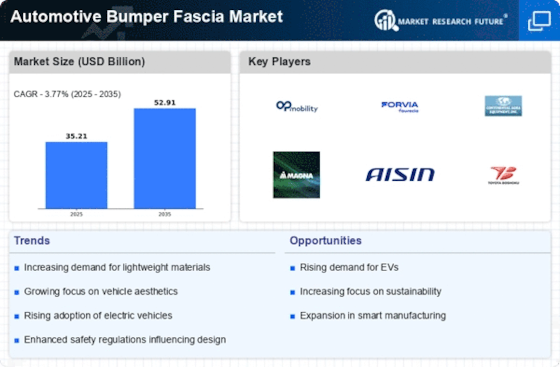

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Automotive Bumper Fascia Market. As manufacturers pivot towards EV production, the need for lightweight and aerodynamic components becomes paramount. Bumper fascias designed for EVs often utilize advanced materials that enhance energy efficiency and range. In 2025, the EV market is projected to account for a substantial share of new vehicle sales, thereby propelling the demand for specialized bumper fascias. This shift not only influences design but also necessitates innovations in manufacturing processes to accommodate the unique requirements of electric drivetrains. Consequently, the Automotive Bumper Fascia Market is likely to experience significant growth as it aligns with the evolving landscape of vehicle electrification.

Consumer Preference for Customization

The growing consumer preference for vehicle customization is reshaping the Automotive Bumper Fascia Market. As consumers seek to personalize their vehicles, manufacturers are responding by offering a wider array of bumper fascia designs and finishes. This trend is particularly evident in the aftermarket segment, where consumers are willing to invest in unique styles that reflect their individual tastes. The demand for customized bumper fascias is expected to rise, driven by the increasing popularity of vehicle modification culture. In 2025, this shift is likely to encourage manufacturers to diversify their product offerings, thereby enhancing competition within the Automotive Bumper Fascia Market. Customization not only adds aesthetic value but also allows consumers to enhance functionality, further driving market growth.

Regulatory Compliance and Safety Standards

The stringent regulatory environment surrounding vehicle safety is a significant driver for the Automotive Bumper Fascia Market. Governments worldwide are implementing rigorous safety standards that necessitate the incorporation of advanced safety features into vehicle designs. Bumper fascias play a crucial role in absorbing impact and protecting pedestrians, which has led to increased investments in research and development. In 2025, compliance with these regulations is expected to drive manufacturers to innovate and enhance the performance of bumper fascias. This focus on safety not only influences design choices but also impacts material selection, as manufacturers seek to balance safety with weight and cost considerations. Thus, the Automotive Bumper Fascia Market is poised for growth as it adapts to these evolving regulatory demands.

Technological Advancements in Manufacturing

Technological innovations in manufacturing processes are transforming the Automotive Bumper Fascia Market. The advent of techniques such as 3D printing and automated assembly lines enhances production efficiency and reduces costs. These advancements allow for greater design flexibility, enabling manufacturers to create complex shapes and integrate features that were previously challenging to achieve. As a result, the market is witnessing an influx of new designs that cater to consumer preferences for aesthetics and functionality. Furthermore, the integration of smart technologies into bumper fascias, such as sensors for collision detection, is becoming increasingly prevalent. This trend indicates a shift towards more sophisticated automotive components, thereby driving growth in the Automotive Bumper Fascia Market.

Sustainability Initiatives in Automotive Manufacturing

Sustainability initiatives are becoming increasingly influential in the Automotive Bumper Fascia Market. As environmental concerns gain prominence, manufacturers are exploring eco-friendly materials and production methods. The shift towards sustainable practices is not merely a trend; it is becoming a necessity as consumers demand greener products. In 2025, the market is likely to see a rise in the use of recycled materials in bumper fascia production, which aligns with broader industry goals of reducing carbon footprints. This commitment to sustainability may also lead to innovations in material science, resulting in the development of new composites that are both lightweight and environmentally friendly. Consequently, the Automotive Bumper Fascia Market is expected to evolve in response to these sustainability pressures, fostering a more responsible approach to automotive manufacturing.