Market Trends

Introduction

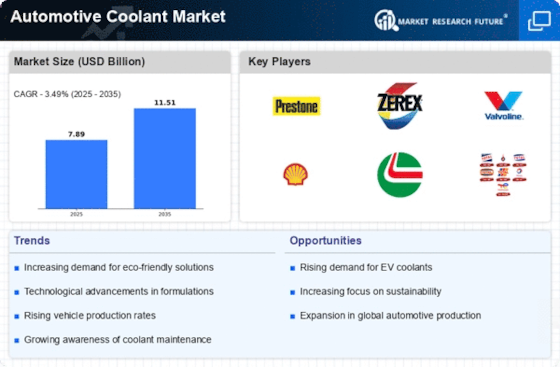

The market for automobile cooling liquids is undergoing major changes as we enter the year 2024, owing to a confluence of macroeconomic factors. The technological development of automobiles is leading to more efficient and more eco-friendly cooling fluids, while governmental efforts to reduce emissions and improve vehicle performance are reshaping product standards. Also, the changing consumer behavior, a trend towards products that are both sustainable and high-quality, is influencing the purchasing decisions. These trends are of strategic importance for all the market participants. They not only influence product development and compliance strategies but also the market positioning and the competitive structure.

Top Trends

-

Sustainability Initiatives

With increasing pressure from the authorities to comply with ever more stringent regulations, the industry is concentrating on developing more eco-friendly coolant formulations. For example, BASF has developed bio-based coolants that reduce the carbon footprint. The European Union’s Green Deal, with its goal of reducing emissions, is pushing manufacturers to innovate. This trend will also benefit brand loyalty among consumers who are aware of their responsibility to the environment. Biodegradable coolants are likely to become more widespread in the future, and the use of traditional coolant components will be subject to ever stricter controls. -

Technological Advancements

In recent years, the integration of advanced technology into the cooling systems has increased. ExxonMobil has invested heavily in research and development in order to develop high-performance coolants that increase engine efficiency. Data shows that the cooling requirements of modern engines are more complex and the product portfolio is shifting accordingly. This trend may result in higher operating costs for manufacturers but can improve the performance of products and customer satisfaction. -

Electric Vehicle Coolants

Electric vehicles (EVs) are gaining market share, and demand for special coolants is rising accordingly. Coolants developed by Total Energy have been developed for use in the batteries of EVs. A projection by the International Energy Agency forecasts a 40% increase in the sale of EVs by 2023, which indicates a growing market. This trend will lead to the development of new coolants and new opportunities for coolant manufacturers. -

Global Supply Chain Challenges

The car industry is still experiencing supply disruptions that are affecting the availability of coolants. Among other things, Chevron has reported delays in obtaining raw materials due to the current political situation. According to industry reports, in 2023, 70 per cent of manufacturers had supply chain problems. This trend may lead to price increases and a push towards local sourcing strategies on the part of coolant producers. -

Regulatory Compliance and Safety Standards

Markets are being shaped by stricter regulations on the safety and the environment of cooling fluids. These regulations, such as the EPA's guideline on hazardous substances, are being enforced by governments. These regulations are the basis for ensuring that the products of companies like Shell are safe and sustainable. This trend may result in higher operating costs, but it will increase the credibility of the products and the trust of consumers. -

Consumer Awareness and Education

There is growing emphasis on the education of consumers in the choice of coolants and their care. Brands such as Prestone are investing in advertising to educate consumers about the importance of choosing the right coolant. According to research, around 60% of consumers are unaware of the coolant types and their benefits. This trend may result in a demand for educational resources and an impact on purchasing decisions. -

Increased Competition and Market Consolidation

Competition in the automobile coolant market is growing. This may lead to further mergers and acquisitions. Valvoline, for example, is trying to expand its product range in order to gain market share. An analysis of the industry shows that up to 30 per cent of small manufacturers may not be able to compete with the big companies. This could lead to a more consolidated market, with consequences for price strategy and product diversity. -

Focus on Performance Enhancements

Coolant manufacturers are placing performance-enhancing additives at the forefront of their formulations. For example, Motul has introduced coolants which improve heat transfer and reduce engine wear. A study by the American Automobile Association shows that engines using these coolants can be extended by up to 20 per cent. This trend could lead to higher R&D expenditure and a shift in consumer preferences towards premium products. -

Digital Transformation in Marketing

The cooling fluid market has embraced digital marketing strategies to reach consumers. Brands like Castrol are promoting their products on social media and e-commerce platforms. Data shows that in 2023 the e-commerce sales of auto parts rose by 25 percent. This trend is likely to raise the profile of brands and increase the engagement of consumers, thereby driving sales in the digital space. -

Emerging Markets Growth

The emerging markets are becoming significant players in the field of car coolants. In countries such as India and Brazil, the number of vehicles is growing, which is driving the demand for coolants. According to reports, the consumption of coolants in these countries is expected to grow by 15 per cent annually. This growth may encourage manufacturers to develop new products, such as coolants that are more suited to the tastes of local consumers, and to invest in distribution networks to take advantage of this growth.

Conclusion: Navigating the Competitive Coolant Landscape

The 'Automotive Coolant' market is characterized by an intense competition and a high degree of fragmentation. The competition between the established and the newcomers is very strong. The demand for coolants that are both environmentally friendly and high in performance is increasing in the individual regions. This leads to innovations and new product developments. The established companies use their brand name and their distribution network to differentiate themselves, while the newcomers are focusing on sustainability and advanced technology. For the suppliers, the strategic requirement is to invest in the development of artificial intelligence for the purpose of predicting wear and tear, automation for the purpose of increasing productivity, and flexibility for responding to changing customer requirements. The companies that are able to combine these three aspects in the best possible way will probably be the market leaders in the future.

Leave a Comment