Research Methodology on Automotive Coolant Market

Introduction

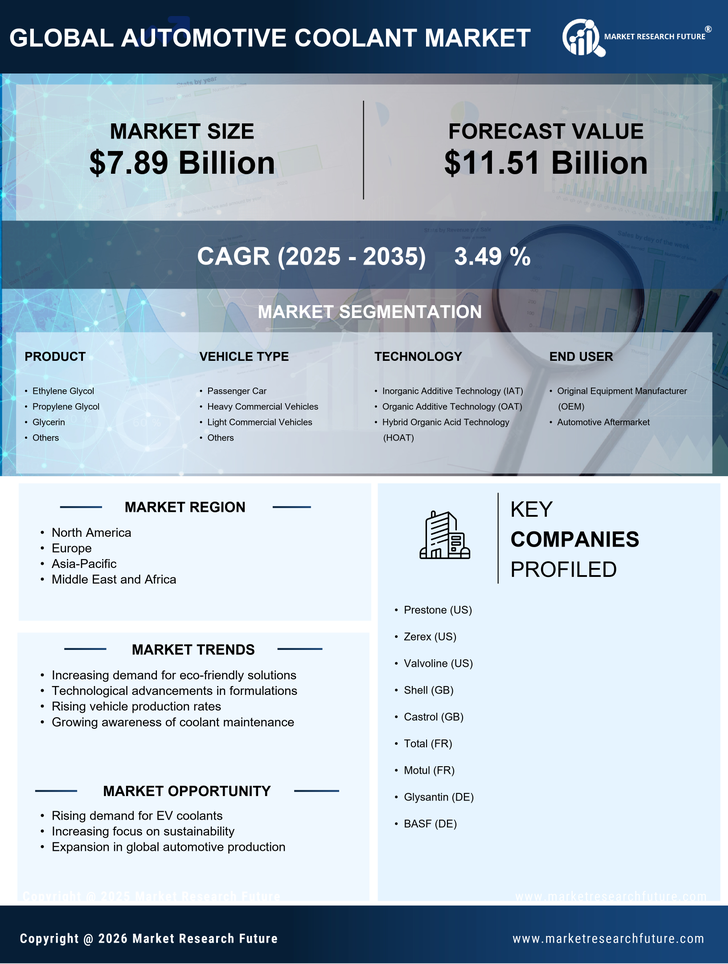

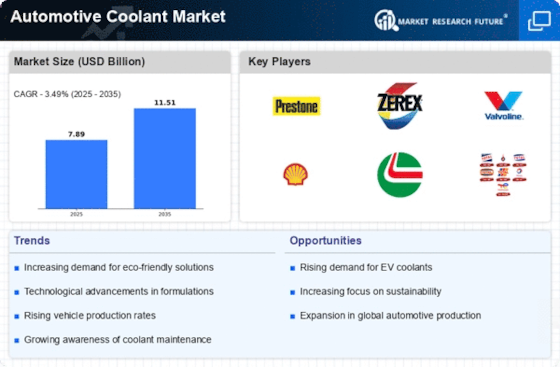

The global automotive coolant market is expected to grow significantly in the forecast period between 2023-2030. The surging automotive coolant demand is due to the rising demand for automobiles worldwide. With the rise in the purchasing power of customers, there is an increase in the demand for automobiles. The automotive industry is being driven by technological advancements and innovations that are making automobiles more efficient and powerful. The increasing use of advanced materials in the manufacture of automobiles is leading to an increase in the need for automotive coolant. Automotive coolant also has numerous applications ranging from heat exchange, preventing corrosion, and heat transfer in the internal combustion engine.

Research Methodology

This research report uses various market research techniques such as primary and secondary research, and qualitative and quantitative analysis to understand and analyze the key market drivers, restraints, opportunities and trends for the global automotive coolant market. The research methodology adopted in this report is detailed as follows:

1. Primary Research

Primary research techniques were used to collect qualitative and quantitative data from both primary and secondary sources. The primary research conducted included interviews with industry experts (such as automotive OEMs, key market players, automotive coolant resellers, and other stakeholders). These interviews provide remarkable insights and information about the market dynamics and trends concerning the automotive coolant industry.

The primary interviews were conducted with the help of a structured questionnaire. The questions posed contained topics on the market overview, competitive landscape, pricing trends, product trends, competitive landscape, and regulatory policies. All primary interviews were conducted using a structured interview guide.

At the same time, their opinions have also been collected and questions have been asked regarding the customer segment, geographical segment, and application segment.

Primary data collected through interviews and surveys were validated by conducting reviews of white papers, trade reports, press releases, magazine articles, SEC filings, industry associations, and related reports. In particular, insights into the customer base, geographical segment, application segment, and other market parameters were collected from online publications, industry publications, industry newspapers, company websites, and company meetings.

2. Secondary Research

The research team collected data from secondary sources such as the Financial Times, Bloomberg, British Petroleum, The Wall Street Journal, Goldman Sachs, and Factiva.

At the same time, secondary research was conducted to understand and analyse the global automotive coolant market with the help of widespread and comprehensive database services such as Hoovers, trade journals, Factiva, OneSource, and others.

This data is used to understand and interpret the in-depth market progressions and global automotive coolant market dynamics. The research team then used the data to interpret market trends and build forecasting models.

3. Analyst Tools

To interpret and assess the competitors, product portfolio, and customer base, SWOT analysis, Porter's Five Forces analysis, market opportunities and comparison matrix analysis were used. Through these tools, the research team examined the internal and external factors affecting the market.

4. Market Estimations

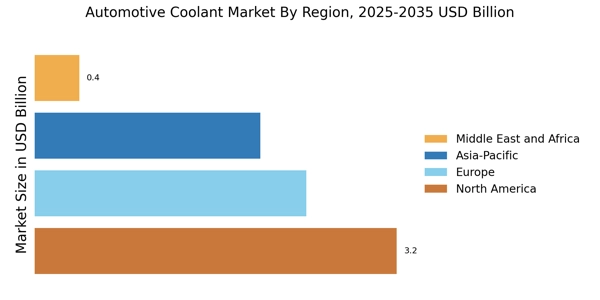

The estimation of the automotive coolant market was done through the top-down and bottom-up approaches. The estimates were made from the analysis of regional market trends, demand, and contributions along with the inputs from the primary and secondary stakeholders.

5. Data Triangulation

Validation of the automotive coolant market and its segment data is obtained with simultaneous usage of surveys, interviews, and secondary data. The data is triangulated post-collection and collation process about the true figures and market developments. Furthermore, the individual value and importance of the market segments, various trends, and various dynamics of the market were validated. Market estimations and size range were calculated using econometric tools and analysis by using the macroeconomic indicators and extensive market review, past developments, and future outlook.

Conclusion

Companies are increasingly developing and introducing new products in the automotive coolant market to gain market share. The primary and secondary research conducted for this report reveals the potential of automotive coolant, thus, positioning the market for a growth surge from 2023 to 2030.