Automotive Interior Decorative Trim Market Summary

As per Market Research Future analysis, the Automotive Interior Decorative Trim Market was estimated at 18.2 USD Million in 2024. The automotive interior decorative trim industry is projected to grow from USD 18.99 Million in 2025 to USD 29.05 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.34% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Interior Decorative Trim Market is experiencing a dynamic shift towards sustainability and technological advancements.

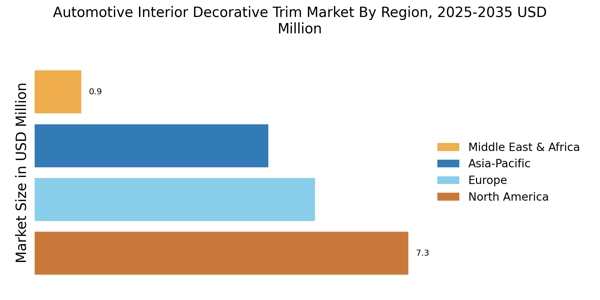

- North America remains the largest market for automotive interior decorative trim, driven by high consumer demand and advanced manufacturing capabilities.

- Asia-Pacific is identified as the fastest-growing region, reflecting increasing automotive production and rising disposable income.

- Decorative films dominate the market as the largest segment, while decorative textiles are emerging as the fastest-growing segment due to consumer preferences for unique designs.

- Key market drivers include sustainability in materials and technological integration, which are shaping product development and consumer choices.

Market Size & Forecast

| 2024 Market Size | 18.2 (USD Million) |

| 2035 Market Size | 29.05 (USD Million) |

| CAGR (2025 - 2035) | 4.34% |

Major Players

Adient (US), Lear Corporation (US), Faurecia (FR), Toyota Boshoku (JP), Magna International (CA), BASF (DE), Continental AG (DE), Aptiv (IE), Sewon (KR)