Increasing Demand for Fuel Efficiency

The Automotive Diesel Engine Intake Valve Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to enhance engine performance while minimizing fuel consumption. This trend is reflected in the growing adoption of advanced intake valve technologies, which optimize air-fuel mixtures and improve combustion efficiency. According to recent data, vehicles equipped with advanced diesel engines can achieve fuel efficiency improvements of up to 20%. Consequently, the Automotive Diesel Engine Intake Valve Market is likely to witness significant growth as automakers strive to meet stringent fuel economy regulations and consumer expectations.

Shift Towards Hybrid and Electric Vehicles

The Automotive Diesel Engine Intake Valve Market is also influenced by the shift towards hybrid and electric vehicles. While this transition may seem counterintuitive to the diesel market, it presents opportunities for innovation. Manufacturers are exploring hybrid systems that incorporate diesel engines, necessitating advanced intake valve technologies to optimize performance. The integration of diesel engines in hybrid applications can enhance overall efficiency and reduce emissions. As the automotive landscape evolves, the Automotive Diesel Engine Intake Valve Market may adapt to these changes, potentially leading to new product developments and market strategies.

Technological Innovations in Engine Design

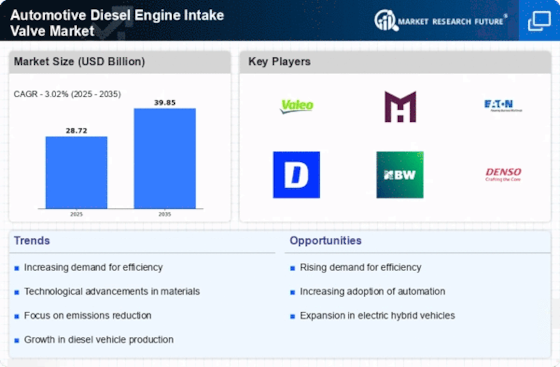

Technological advancements in engine design are driving the Automotive Diesel Engine Intake Valve Market forward. Innovations such as variable valve timing and electronically controlled intake valves are becoming increasingly prevalent. These technologies allow for precise control of valve operation, leading to improved engine performance and reduced emissions. The integration of smart technologies, such as sensors and actuators, further enhances the functionality of intake valves. As manufacturers continue to invest in research and development, the market is poised for growth, with projections indicating a compound annual growth rate of approximately 5% over the next five years.

Regulatory Compliance and Emission Standards

The Automotive Diesel Engine Intake Valve Market is significantly influenced by stringent emission regulations imposed by various governments. These regulations aim to reduce harmful emissions from diesel engines, prompting manufacturers to innovate and adopt advanced intake valve technologies. The introduction of new standards, such as Euro 6 and EPA Tier 3, necessitates the development of valves that can withstand higher pressures and temperatures while ensuring optimal performance. As a result, the market is expected to expand as manufacturers invest in research and development to comply with these regulations, thereby enhancing the overall efficiency and sustainability of diesel engines.

Rising Popularity of Diesel Engines in Commercial Vehicles

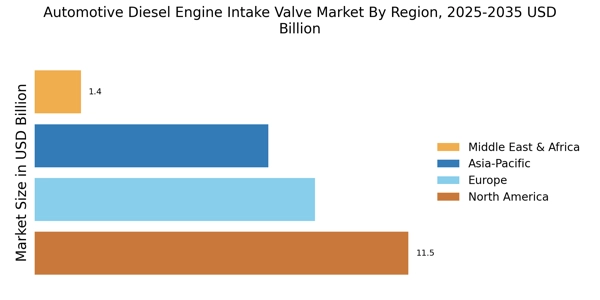

The Automotive Diesel Engine Intake Valve Market is bolstered by the rising popularity of diesel engines in commercial vehicles. Diesel engines are favored for their durability, fuel efficiency, and torque characteristics, making them ideal for heavy-duty applications. The increasing demand for logistics and transportation services has led to a surge in the production of commercial vehicles, which in turn drives the need for high-performance intake valves. Market data suggests that the commercial vehicle segment is expected to account for a substantial share of the overall diesel engine market, further propelling the growth of the Automotive Diesel Engine Intake Valve Market.