Rising Demand for Enhanced Safety Features

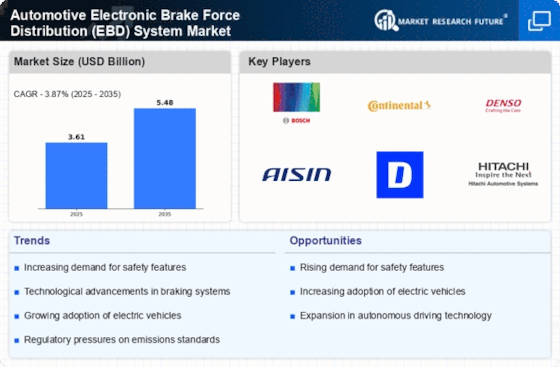

The Automotive Electronic Brake Force Distribution (EBD) System Market is experiencing a notable surge in demand for enhanced safety features in vehicles. As consumers become increasingly aware of the importance of safety, manufacturers are compelled to integrate advanced braking systems, including EBD, to meet these expectations. According to recent data, the automotive safety systems market is projected to grow significantly, with EBD systems playing a crucial role in this expansion. The ability of EBD to optimize brake force distribution based on load conditions enhances vehicle stability and reduces stopping distances, thereby appealing to safety-conscious consumers. This trend is likely to drive investments in EBD technology, as automakers strive to differentiate their offerings in a competitive landscape.

Regulatory Pressure for Enhanced Vehicle Safety

Regulatory pressure is a significant driver for the Automotive Electronic Brake Force Distribution (EBD) System Market. Governments worldwide are implementing stringent safety regulations aimed at reducing road accidents and enhancing vehicle safety standards. These regulations often mandate the inclusion of advanced braking systems, including EBD, in new vehicle models. As a result, automakers are increasingly adopting EBD technology to comply with these regulations and avoid penalties. Data from various regulatory bodies indicates a trend towards more rigorous safety assessments, which further propels the demand for EBD systems. This regulatory landscape is likely to foster innovation and investment in EBD technology, as manufacturers seek to meet evolving safety requirements.

Technological Advancements in Automotive Systems

Technological advancements are a pivotal driver for the Automotive Electronic Brake Force Distribution (EBD) System Market. Innovations in sensor technology, data processing, and vehicle dynamics have enabled the development of more sophisticated EBD systems. These advancements allow for real-time adjustments to brake force distribution, enhancing vehicle control and safety. The integration of EBD with other systems, such as anti-lock braking systems (ABS) and traction control, further amplifies its effectiveness. Market data indicates that the automotive electronics sector is expected to witness substantial growth, with EBD systems being a key component. As manufacturers invest in research and development, the proliferation of advanced EBD systems is anticipated to reshape the automotive landscape.

Increasing Adoption of Electric and Hybrid Vehicles

The shift towards electric and hybrid vehicles is significantly influencing the Automotive Electronic Brake Force Distribution (EBD) System Market. As these vehicles gain popularity, the demand for efficient braking systems that can accommodate their unique dynamics is rising. EBD systems are particularly well-suited for electric and hybrid vehicles, as they can optimize braking performance while managing energy regeneration. Market analysis suggests that the electric vehicle segment is poised for exponential growth, which will likely drive the adoption of EBD systems. This trend indicates a potential for manufacturers to innovate and enhance EBD technology to cater to the specific needs of electric and hybrid vehicles, thereby expanding their market presence.

Consumer Preference for Advanced Vehicle Technologies

Consumer preference for advanced vehicle technologies is a driving force in the Automotive Electronic Brake Force Distribution (EBD) System Market. As consumers seek vehicles equipped with the latest technological features, the demand for EBD systems is expected to rise. EBD enhances driving experience by providing better control and stability, which resonates with tech-savvy consumers. Market Research Future indicates that a significant portion of consumers prioritize safety and technology when purchasing vehicles, leading manufacturers to incorporate EBD systems as standard features. This consumer trend is likely to encourage automakers to invest in EBD technology, ensuring that their vehicles meet the expectations of modern buyers.