Automotive Engine Encapsulation Market Summary

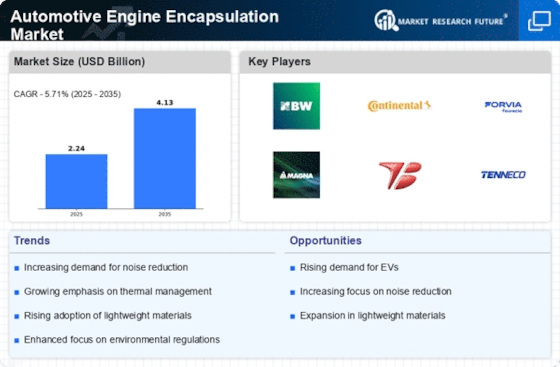

As per Market Research Future analysis, the Automotive Engine Encapsulation Market was estimated at 2.241 USD Billion in 2024. The Automotive Engine Encapsulation industry is projected to grow from 2.369 USD Billion in 2025 to 4.128 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.71% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Engine Encapsulation Market is poised for growth driven by sustainability and technological advancements.

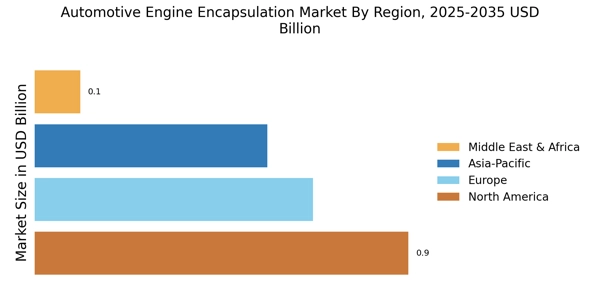

- North America remains the largest market for automotive engine encapsulation, reflecting a strong demand for noise reduction and fuel efficiency.

- The Asia-Pacific region is the fastest-growing market, propelled by increasing automotive production and consumer preferences for advanced materials.

- Polypropylene dominates the market as the largest segment, while polyurethane is emerging as the fastest-growing segment due to its superior properties.

- Key market drivers include stringent emission regulations and the rising demand for noise reduction, particularly in the context of electric vehicle integration.

Market Size & Forecast

| 2024 Market Size | 2.241 (USD Billion) |

| 2035 Market Size | 4.128 (USD Billion) |

| CAGR (2025 - 2035) | 5.71% |

Major Players

BorgWarner (US), Continental (DE), Faurecia (FR), Magna International (CA), Toyota Boshoku (JP), Tenneco (US), Schaeffler (DE), Harman International (US), Aisin Seiki (JP)