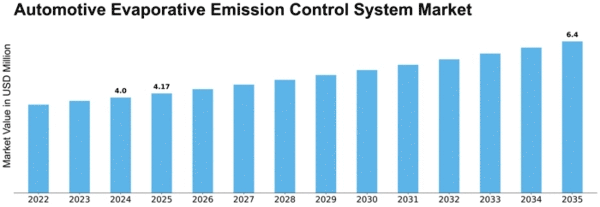

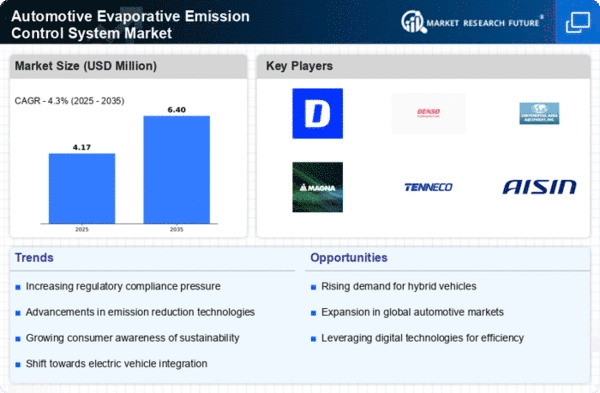

Automotive Evaporative Emission Control System Size

Automotive Evaporative Emission Control System Market Growth Projections and Opportunities

There is a lot of movement in the Automotive Evaporative Emission Control System (EVAP) market brought about by various factors affecting the automotive industry. In vehicles, EVAP systems play a crucial role in minimizing exhaust gases which are harmful to the environment especially emissions due to evaporation of fuel. The stringent environmental regulations and global shift towards clean energy sources have accelerated demand for effective emission control systems, thereby making the market highly dynamic.

More changes in this market dynamics are being caused by increased use of electric vehicles (EVs) and transition into alternative propulsion technologies. Though themselves producing no tailpipe emissions at all, automobile industry understands that entire life cycle including production and disposal should be accounted for. Thus, EVAP systems have been modified to suit changing requirements of hybrid and electric vehicles so as to remain environmentally friendly throughout their lifespan.

The global Automotive EVAP market has also witnessed shifts within its competitive settings. This has led both established companies and newcomers alike competing aggressively against each other through provision of low-cost solutions comprising high technology products respectively just gain some competitive edge. Furthermore, there is an increasing trend where businesses partner with each other through research ventures, manufacturing assistance as well as distribution collaborations since they want to optimize on their strengths in these areas. This kind of fierce competition propels advancements in EVAP system technologies prompting market players to be proactive when it comes meeting consumer expectations.

Another important aspect that drives market dynamics includes consumers’ awareness and choices related to this issue as well as quality preferences of the market. In other words, when customers are getting environmentally conscious they will increasingly demand for vehicles with advanced emission control systems. This shift affects not only purchase decisions made by consumers but also encourages auto manufacturers to focus on ecological sustainability while developing their products. Thus, the Automotive EVAP market is driven by compliance requirements as well as consumer demand resulting in a multi-dimensional dynamism that necessitates an all-inclusive industry approach.

To sum up, regulatory pressures, technological advancements, the shift towards alternative propulsion systems, changing competitive landscapes and evolving consumer preferences shape market dynamics of Automotive Evaporative Emission Control Systems. As such, this dynamic environment promotes constant innovation and adaptation through collaboration within the automotive sector to achieve cleaner and sustainable transportation solutions.

Leave a Comment