Market Trends

Key Emerging Trends in the Automotive Evaporative Emission Control System Market

The Automotive Evaporative Emission Control System (EVAP) market is a dynamic place where companies employ different approaches for winning a larger share of this highly competitive field. This involves developing unique features or characteristics about their EVAP systems hence differentiating them from those produced by other manufacturers. Companies do this by incorporating cutting-edge technologies such as better leak detection or enhanced fuel vapor recovery which helps them stand out in a highly crowded space. Prominent among these are environment-sensitive consumers who find it easier to be identified with products which are ahead of their time.

Another strategy is cost leadership whereby companies focus on producing EVAP systems at a lower cost without sacrificing quality and this enables them to offer competitive prices in the market thereby attracting more consumers. Companies achieve cost leadership through economies of scale, efficient production processes, and strategic supplier alliances. In addition, the provision of affordable solutions allows businesses to take up larger proportion of the market especially in price sensitive markets.

Furthermore, market segmentation is a common positioning strategy used by companies in the Automotive EVAP industry besides differentiation as aforementioned. Knowledge about various customer segments’ distinct needs enables a company to tailor products according to specific preferences. For example, some customers value fuel efficiency while others are concerned about environmental friendliness. This creates an opportunity for differentiating EVAP systems targeting each niche market that they serve well.

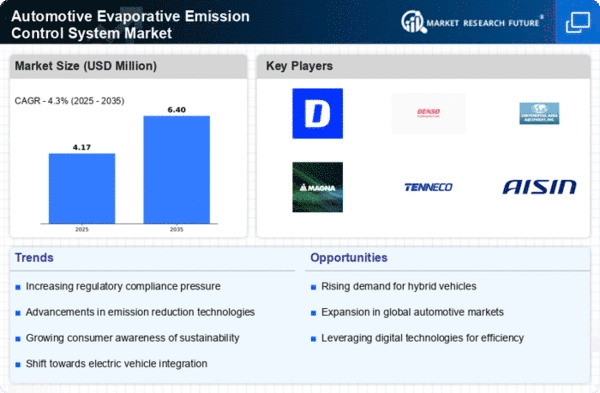

Moreover, geographical expansion is an important strategy for firms seeking to grow their share of the Automotive EVAP market. Demand for emission control systems differs across regions due to variations in regulations, environmental concerns and technological choices. Companies therefore develop their products specifically to meet different regional requirements based on certain reasons. For instance, if one enters into highly demanding regions around the globe with expansions like these companies can grab more global pie.

The automotive industry employs a dynamic approach that entails constant innovative ideas and adjustments in relation to dynamic technologies, which are critical determinants of market share position within the Automotive EVAP Industry. With an increasingly progressive automotive sector, those who keep up with these innovation and laws changes will have an advantage over their competitors since they will be able to satisfy customer needs. This suppleness allows them to exploit emerging prospects, keeping one step ahead of their rivals.

Leave a Comment