Market Share

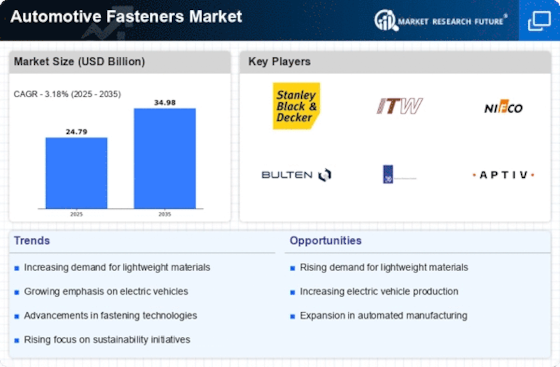

Automotive Fasteners Market Share Analysis

In the market for automotive fasteners, positioning strategies with respect to holding a share of markets are critically important in determining whether companies will succeed. These tactics include the planned activities carried out by companies to ensure a good share of market and advantage over competitors. Differentiating is one of many strategies used by companies to set themselves apart from competitors via unique features, high quality, or interesting designs. This leads to a brand identity that appeals to customers, allowing firms to be able of charging premiums and create a captive customer base. The other crucial strategy is cost leadership, where firms strive to become low-cost producers in the market. To offer competitive prices for the products, companies should develop optimized production processes that reduce operational costs and lead to economies of scale. This appeals to cost-effective customers and allows businesses to control a greater market segment. But it is important to find a balance between cost and quality, so as not lose product integrity. Market segmentation is also an important aspect of market share positioning in the automotive fasteners industry. Companies target certain segments of customers with the identified needs and preferences, offering them products that are most relevant for them. For instance, some firms can concentrate on specifically specialty fasteners for luxury cars whereas others may aim at the aftermarket with a lineup of versatile and broadly compatible products. This focused approach enables firms to identify the needs of various customer segments and create a strong foothold in specific market niches. The development of collaborations and the implementation of partnership models have become common practices in automotive fasteners market. Companies understand the importance of developing alliances with appropriate players in their industry, such as automakers, suppliers, and distributors. The resulting partnerships may become reciprocal arrangements such as exclusive supply contracts, joint product design or complimentary distribution systems. Companies can improve their market coverage as well as reach new customer bases, and thus grow its markets share by taking advantage of each parties’ capabilities. Increased market share positioning in the automotive fasteners sector is powered by technological innovation. In case of companies investing in R&D to produce leading-edge fastening technologies, a competitive advantage is gained. From the development of lightweight and high-strength materials to corrosion resistance improvement, ease installment turnout or other technical developments that make products stand out from competitors’ product while satisfying customers. Through pursuing technological evolution, firms can occupy a larger market because it provides solutions that meet the required standards of emerging industry trends.

Leave a Comment