Top Industry Leaders in the Automotive Front end Module Market

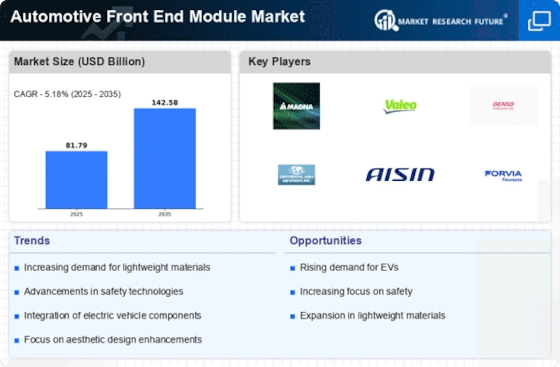

The automotive front end module (FEM) market stands as a complex and ever-evolving landscape marked by fierce competition among major industry players. Projections indicate significant growth in the years ahead, fueled by the increasing demand for lightweight vehicles, stringent safety regulations, and the widespread adoption of advanced driver assistance systems (ADAS).

The automotive front end module (FEM) market stands as a complex and ever-evolving landscape marked by fierce competition among major industry players. Projections indicate significant growth in the years ahead, fueled by the increasing demand for lightweight vehicles, stringent safety regulations, and the widespread adoption of advanced driver assistance systems (ADAS).

Key Player Strategies Adopted:

Prominent players in the FEM market, including-

Mahle GmbH

Faurecia SA

Denso Corporation

Calsonic Kansei Corporation

Hbpo Group

Magna International Inc.

Hyundai Mobis

Plastic Omnium

SL Corporation

Valeo S.A., and others.

consistently innovate and adopt diverse strategies to fortify their market share and secure a competitive advantage. Some of the key strategies include:

-

Product Differentiation: Companies focus on developing innovative FEM products with advanced features. This involves the incorporation of lightweight materials such as composites and aluminum, integration of ADAS sensors, and enhancements in fuel efficiency.

-

Geographic Expansion: Active expansion into emerging markets, particularly in Asia Pacific and South America, involves establishing new manufacturing facilities and forming partnerships with local entities to tap into regions experiencing rapid growth in the automotive industry.

-

Strategic Partnerships: Collaborations with other automotive ecosystem players, including OEMs, component suppliers, and technology firms, enable leveraging each other's expertise and resources for mutual product and solution enhancement.

-

Vertical Integration: Some players opt for vertical integration, gaining better control over their supply chain and improving production efficiency. This includes acquiring or developing capabilities in material production, component manufacturing, and assembly.

-

Investments in R&D: Leading players invest significantly in research and development to stay ahead in technological innovation. This encompasses the development of new materials, testing and refining emerging technologies, and exploring trends like autonomous driving.

Factors for Market Share Analysis:

Several factors play a crucial role in analyzing market share within the FEM market:

-

Revenue: The most common metric used, reflecting a company's financial performance.

-

Volume: The total number of FEM units shipped by a company.

-

Market Coverage: The geographical reach of a company's FEM business.

-

Product Portfolio: The breadth and depth of a company's FEM product offerings.

-

Customer Base: Identification of key customers, including major OEMs and Tier 1 suppliers.

-

Brand Reputation: Reflecting the overall perception of a company's brand in the market.

By analyzing these factors, companies can gain insights into their competitive position and identify areas for improvement.

New and Emerging Trends of Companies:

Several trends are shaping the competitive landscape of the FEM market:

-

Lightweighting: The demand for fuel-efficient vehicles drives the use of lightweight materials such as carbon fiber and aluminum in FEMs.

-

Integration of Electronics: FEMs are increasingly integrated with electronic components and sensors, enabling the development of advanced ADAS functionalities.

-

Modularization: FEMs are designed in a modular fashion, allowing for easier assembly and customization.

-

Digitalization: Adoption of digital technologies like artificial intelligence and machine learning to optimize FEM design and manufacturing processes.

-

Sustainability: Companies focus on developing sustainable FEMs using recycled materials and energy-efficient manufacturing processes.

To thrive in this competitive environment, companies must focus on innovation, strategic partnerships, and operational efficiency. They must also be agile and adaptable to keep pace with rapid technological advancements and changing customer preferences. Companies that effectively address these challenges will be well-positioned to capitalize on growth opportunities in the automotive FEM market.

Industry Developments and Latest Updates:

Mahle GmbH: November 22, 2023: Unveiled a new concept for modular and scalable front-end modules enhancing pedestrian protection and integrating sensor technologies for ADAS functions.

Faurecia SA: October 26, 2023: Signed a collaboration agreement with Plastic Omnium to develop and manufacture front-end modules with sustainable materials and optimized assembly processes.

Denso Corporation: June 23, 2023: Developed a new front-end module for electric vehicles that integrates headlights, radiator, and other components into a single package for improved efficiency and weight reduction.

Calsonic Kansei Corporation: November 1, 2023: Announced a joint development project with a major European automaker for next-generation front-end modules with enhanced aerodynamics and thermal management.