Growth of the Automotive Aftermarket

The Automotive Interconnecting Shaft Market is also benefiting from the expansion of the automotive aftermarket. As vehicle ownership rates rise, the demand for replacement parts and upgrades is increasing. This trend is particularly pronounced in regions with a high density of older vehicles, where the need for maintenance and replacement components is critical. Market data indicates that the automotive aftermarket is expected to grow at a rate of 5% annually, creating substantial opportunities for interconnecting shaft manufacturers. This growth is likely to be fueled by the increasing awareness of vehicle performance and safety, prompting consumers to invest in high-quality aftermarket components.

Increasing Demand for Fuel Efficiency

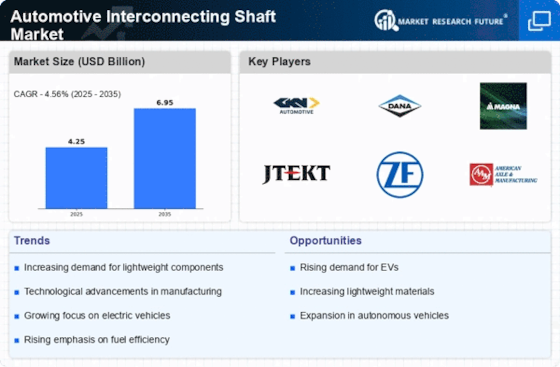

The Automotive Interconnecting Shaft Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to innovate and produce lighter, more efficient vehicles. This trend is reflected in the growing adoption of advanced materials and design techniques that enhance the performance of interconnecting shafts. According to recent data, the automotive sector is projected to witness a compound annual growth rate of approximately 4.5% in the coming years, driven by the need for improved fuel economy. Consequently, the Automotive Interconnecting Shaft Market is likely to benefit from this shift, as manufacturers seek to optimize their products to meet stringent fuel efficiency standards.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent, influencing the Automotive Interconnecting Shaft Market. Governments worldwide are implementing regulations aimed at enhancing vehicle safety and reducing emissions. These regulations necessitate the use of high-quality materials and components, including interconnecting shafts, that meet specific performance criteria. As a result, manufacturers are compelled to invest in research and development to ensure their products comply with these evolving standards. This focus on compliance not only drives innovation but also positions the Automotive Interconnecting Shaft Market for growth, as companies that prioritize safety and quality are likely to gain a competitive edge.

Rising Popularity of Hybrid and Electric Vehicles

The rising popularity of hybrid and electric vehicles is significantly impacting the Automotive Interconnecting Shaft Market. As automakers increasingly shift their focus towards sustainable mobility solutions, the demand for specialized interconnecting shafts designed for electric drivetrains is on the rise. Market analysis suggests that the electric vehicle segment is expected to grow at a staggering rate of 20% annually, creating new opportunities for manufacturers of interconnecting shafts. This shift not only necessitates the development of innovative products but also encourages collaboration between automotive manufacturers and component suppliers, thereby fostering growth within the Automotive Interconnecting Shaft Market.

Technological Advancements in Manufacturing Processes

Technological advancements are playing a pivotal role in shaping the Automotive Interconnecting Shaft Market. Innovations in manufacturing processes, such as precision machining and additive manufacturing, are enabling the production of more complex and efficient interconnecting shafts. These advancements not only enhance the performance and durability of the shafts but also reduce production costs. For instance, the implementation of automated manufacturing techniques has been shown to increase production efficiency by up to 30%. As a result, manufacturers are better positioned to meet the rising demand for high-quality automotive components, thereby driving growth in the Automotive Interconnecting Shaft Market.