Regulatory Compliance and Standards

Regulatory compliance is a critical driver for the Automotive Light Vehicle Sensor Market. Governments worldwide are implementing stringent regulations aimed at enhancing vehicle safety and reducing emissions. These regulations often mandate the inclusion of specific sensor technologies in new vehicles, thereby driving demand within the market. For example, the implementation of the Euro NCAP safety ratings has led to increased pressure on manufacturers to equip vehicles with advanced safety sensors. As a result, the Automotive Light Vehicle Sensor Market is expected to grow as manufacturers strive to meet these regulatory requirements while also appealing to safety-conscious consumers.

Growing Adoption of Electric Vehicles

The shift towards electric vehicles (EVs) is significantly influencing the Automotive Light Vehicle Sensor Market. As more consumers opt for EVs, the demand for specialized sensors that monitor battery performance, energy consumption, and thermal management is increasing. Data indicates that the electric vehicle market is expected to grow at a staggering rate, with projections suggesting that EVs could account for over 30% of total vehicle sales by 2030. This transition necessitates the integration of advanced sensors to optimize vehicle performance and ensure safety. Consequently, the Automotive Light Vehicle Sensor Market is likely to witness a robust expansion as manufacturers adapt to the evolving landscape of electric mobility.

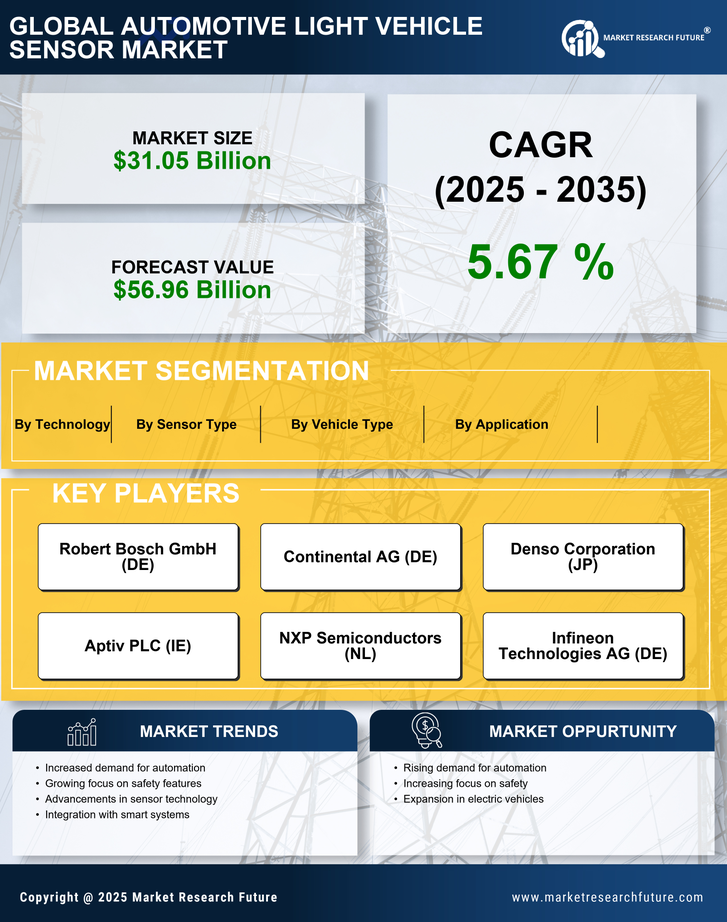

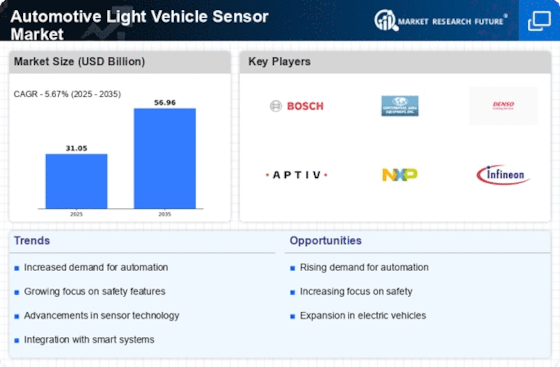

Increasing Demand for Safety Features

The Automotive Light Vehicle Sensor Market is experiencing a surge in demand for enhanced safety features in vehicles. Consumers are increasingly prioritizing safety, leading manufacturers to integrate advanced sensors that support features such as collision avoidance, lane departure warnings, and adaptive cruise control. According to recent data, the market for automotive safety sensors is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is driven by regulatory requirements and consumer preferences for vehicles equipped with state-of-the-art safety technologies. As a result, the Automotive Light Vehicle Sensor Market is likely to see a significant increase in the adoption of sensors that enhance vehicle safety and performance.

Rising Consumer Awareness and Preferences

Consumer awareness regarding vehicle safety and technology is on the rise, significantly impacting the Automotive Light Vehicle Sensor Market. As consumers become more informed about the benefits of advanced sensor technologies, their preferences are shifting towards vehicles equipped with the latest safety and convenience features. This trend is evident in the increasing sales of vehicles with integrated sensor systems, which are perceived as safer and more technologically advanced. Market data suggests that vehicles with advanced sensor technologies are likely to command a premium price, further incentivizing manufacturers to invest in the development of innovative sensor solutions. Consequently, the Automotive Light Vehicle Sensor Market is poised for growth as consumer preferences continue to evolve.

Technological Advancements in Sensor Technology

Technological advancements are playing a pivotal role in shaping the Automotive Light Vehicle Sensor Market. Innovations in sensor technology, such as the development of more accurate and reliable sensors, are enabling manufacturers to create vehicles that are not only safer but also more efficient. For instance, the introduction of LIDAR and radar sensors has revolutionized the way vehicles perceive their environment, facilitating the development of autonomous driving capabilities. The market for these advanced sensors is expected to expand, with estimates suggesting a growth rate of around 10% annually. This trend indicates that the Automotive Light Vehicle Sensor Market is on the brink of a technological renaissance, driven by the need for smarter and more responsive vehicle systems.