Automotive Logging Device Size

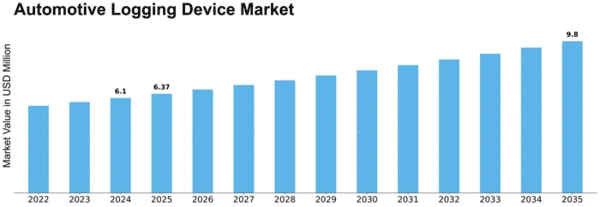

Automotive Logging Device Market Growth Projections and Opportunities

The Automotive Logging Device (ALD) market is a dynamic space within the automotive industry that encompasses devices used for tracking and recording data related to vehicle operations. The market dynamics of ALDs are influenced by several key factors that shape its growth, trends, and competitive landscape.

Firstly, government regulations play a pivotal role in steering the direction of the ALD market. Various regions, such as North America and Europe, have implemented stringent regulations mandating the use of ALDs in commercial vehicles for monitoring driver behavior, ensuring compliance with hours-of-service regulations, and enhancing road safety. These regulatory mandates act as catalysts for the adoption of ALDs, driving market growth and encouraging innovation among industry players to meet compliance standards.

Additionally, technological advancements significantly impact the market dynamics of ALDs. The evolution of telematics and IoT (Internet of Things) technologies has led to the development of more sophisticated and efficient ALD systems. Integration of GPS, sensors, and connectivity features enables ALDs to offer real-time tracking, remote diagnostics, and comprehensive data analytics, empowering fleet managers with actionable insights to optimize vehicle performance, reduce maintenance costs, and improve overall operational efficiency. The continuous innovation in technology shapes the competitive landscape, prompting companies to invest in research and development to stay ahead in the market.

Moreover, the increasing focus on fleet management and logistics optimization drives the demand for ALDs across various industries. Businesses across sectors such as transportation, logistics, construction, and delivery services recognize the value of ALDs in improving fleet productivity, route optimization, fuel efficiency, and ensuring timely deliveries. This heightened demand from diverse industries fuels market expansion and diversification, with ALD providers customizing solutions to cater to specific industry needs.

The competitive landscape of the ALD market is characterized by the presence of both established players and emerging startups. Established companies with extensive experience and a wide customer base strive to maintain their market position through product differentiation, service quality, and geographical expansion. Simultaneously, innovative startups enter the market with disruptive technologies, aiming to capture niche segments by offering unique features or cost-effective solutions. This dynamic competition fosters innovation and drives companies to continuously enhance their offerings to meet evolving customer demands.

Furthermore, the global economic landscape and fluctuations in fuel prices also impact the ALD market dynamics. Economic stability and growth influence the investment capacity of businesses, affecting their willingness to adopt ALD solutions. Fluctuations in fuel prices directly impact operating costs for fleet owners, driving the need for efficient monitoring systems like ALDs to optimize fuel consumption and operational expenses.

The Automotive Logging Device market operates within a dynamic environment shaped by regulatory mandates, technological advancements, industry demands, competitive forces, and economic factors. The interplay of these elements influences market trends, innovation, and the strategies adopted by industry players, ultimately driving the growth and evolution of the ALD market. As technology continues to advance and businesses prioritize efficiency and compliance, the ALD market is poised for further expansion and innovation in the foreseeable future.

Leave a Comment