Focus on Operational Efficiency

In the Logging While Drilling Market LWD Market, there is a pronounced focus on operational efficiency among drilling companies. The need to reduce drilling time and costs has led to the adoption of LWD technologies that provide real-time data and insights. This shift is indicative of a broader trend where companies are increasingly prioritizing efficiency to remain competitive. Data suggests that LWD can reduce drilling time by approximately 20%, which translates to significant cost savings. As the industry continues to evolve, the emphasis on operational efficiency is expected to drive further investment in LWD technologies.

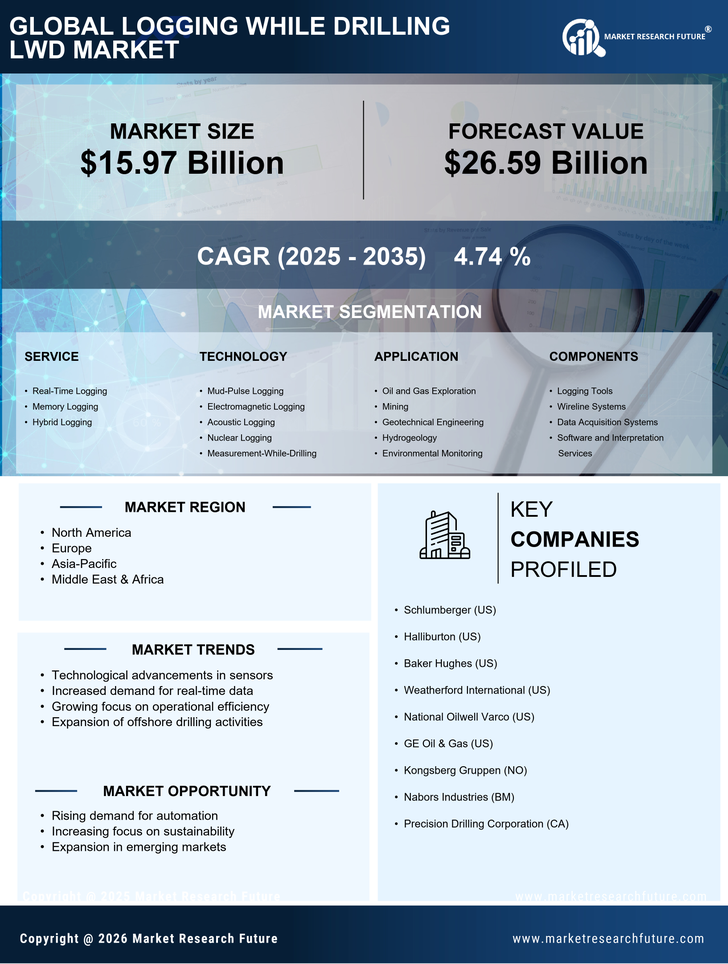

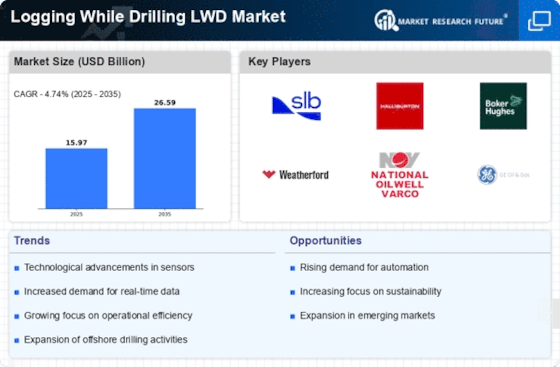

Technological Advancements in LWD

The Logging While Drilling Market LWD Market is experiencing a surge in technological advancements that enhance drilling efficiency and data accuracy. Innovations such as real-time data transmission and advanced sensor technologies are becoming increasingly prevalent. These advancements allow for better decision-making during drilling operations, potentially reducing costs and improving safety. According to recent data, the integration of artificial intelligence and machine learning in LWD systems is projected to increase operational efficiency by up to 30%. As companies seek to optimize their drilling processes, the demand for advanced LWD technologies is likely to grow, driving the market forward.

Rising Demand for Energy Resources

The Logging While Drilling Market LWD Market is significantly influenced by the rising demand for energy resources, particularly in emerging economies. As countries strive to meet their energy needs, the exploration and production of oil and gas are intensifying. This trend is reflected in the increasing number of drilling projects, which, according to industry reports, are expected to rise by 15% over the next five years. The need for efficient drilling techniques, such as LWD, is becoming more critical as companies aim to maximize resource extraction while minimizing environmental impact. Consequently, this growing demand is likely to propel the LWD market.

Environmental Regulations and Compliance

The Logging While Drilling Market LWD Market is also shaped by stringent environmental regulations and compliance requirements. As governments and regulatory bodies impose stricter guidelines on drilling practices, companies are compelled to adopt technologies that minimize environmental impact. LWD technologies, which allow for more precise drilling and reduced waste, are becoming essential in meeting these regulations. The market is witnessing a shift towards sustainable practices, with LWD being a key component in achieving compliance. This trend is likely to foster growth in the LWD market as companies seek to align with environmental standards.

Increased Investment in Oil and Gas Exploration

The Logging While Drilling Market LWD Market is benefiting from increased investment in oil and gas exploration activities. As energy prices stabilize, companies are more willing to invest in advanced drilling technologies to enhance their exploration efforts. This influx of capital is expected to drive the adoption of LWD technologies, which provide critical data for decision-making during drilling operations. Recent statistics indicate that investment in exploration is projected to grow by 10% annually, further fueling the demand for LWD solutions. This trend underscores the importance of LWD in modern drilling practices.