Top Industry Leaders in the Automotive Low Emission Vehicle Market

*Disclaimer: List of key companies in no particular order

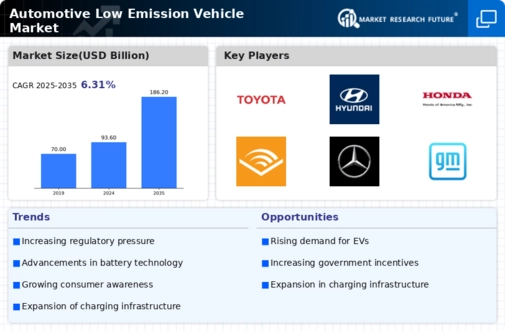

The automotive low-emission vehicle (LEV) market, a crucial battleground in the fight against climate change, is experiencing a rapid and dynamic shift in its competitive landscape. As government regulations tighten, consumer preferences evolve, and technology advances, established giants and nimble innovators are vying for dominance in this electrifying arena.

Volkswagen AG (Germany)

Nissan Motor Company Ltd (Japan)

Daimler AG (Germany)

Honda Motor Company, Ltd. (Japan)

The Ford Motor Company (U.S.)

Toyota Motor Corporation (Japan)

General Motors Company (U.S.)

BMW AG (Germany)

Isuzu Motors Ltd. (Japan)

Tesla, Inc. (U.S.)

The Hyundai Motor Company (South Korea)

Mitsubishi Motors Corporation, and others.

Key Player Strategies:

Legacy Automakers: Established players like Toyota, Volkswagen, and General Motors leverage their vast production capacities, global networks, and brand recognition to maintain their market share. They focus on expanding their LEV portfolios, including hybrids, plug-in hybrids, and full battery electric vehicles (BEVs), while leveraging existing manufacturing infrastructure and supply chains. For example, Volkswagen's aggressive "ID." family of BEVs represents their commitment to EV dominance.

Tech-Savvy Startups: Tesla, Rivian, and Lucid Motors are disrupting the market with cutting-edge battery technology, innovative vehicle design, and software-driven features. They prioritize long driving range, fast charging capabilities, and advanced connected car technologies, catering to tech-savvy early adopters. Tesla's Model 3 continues to dominate the global BEV market, demonstrating the success of their disruptive approach.

Luxury Brands: BMW, Mercedes-Benz, and Audi are leveraging their premium brand image and high-performance technology to position themselves as leaders in the luxury LEV segment. They focus on high-end features, luxurious interiors, and performance-oriented BEVs to attract affluent customers. Mercedes-Benz's EQS flagship BEV showcases their commitment to luxury electrification.

Challengers from Emerging Markets: Chinese automakers like BYD and NIO are making waves with their cost-effective and feature-rich BEVs, targeting budget-conscious consumers in their domestic market and beyond. BYD's strong battery production capabilities and vertically integrated supply chain give them a competitive edge.

Factors for Market Share Analysis:

Product Portfolio Breadth: Offering a diverse range of LEVs across various types (hybrids, PHEVs, BEVs) and segments (economy, luxury, performance) caters to a wider customer base and boosts market share.

Technology Innovation: Investing in R&D for next-generation battery technology, efficient electric motors, and fast-charging infrastructure is crucial for staying ahead of the curve. Companies leading in battery range and charging speed gain an edge.

Cost and Affordability: Balancing innovative technology with competitive pricing is crucial for mass adoption. Companies addressing range anxiety and affordability concerns through efficient production and innovative financing models stand out.

Charging Infrastructure Access: Collaborating with governments and infrastructure providers to expand charging networks across urban and rural areas is essential for boosting consumer confidence and encouraging LEV adoption.

New and Emerging Trends:

Battery Technology Advancements: Solid-state batteries with higher energy density, faster charging times, and improved safety are on the horizon, promising significant leaps in EV performance and range. Companies investing in this technology gain a future advantage.

Vehicle-to-Grid (V2G) Integration: Utilizing BEVs as energy storage sources and feeding power back into the grid during peak demand periods is gaining traction. Companies enabling V2G capabilities offer additional value to utilities and grid operators.

Subscription Models and Shared Mobility: Shifting ownership models towards subscription services and car-sharing platforms are making LEVs more accessible and appealing to younger generations. Companies offering innovative ownership and usage models capture new market segments.

Focus on Circular Economy: Using sustainable materials, implementing efficient recycling processes, and extending vehicle lifespans are becoming increasingly important. Companies demonstrating environmentally responsible practices attract eco-conscious consumers.

Overall Competitive Scenario:

The automotive LEV market is a dynamic and fiercely competitive space, with diverse players employing varied strategies. Legacy automakers leverage their established presence, while tech-savvy startups challenge with disruptive innovations. Luxury brands capitalize on their premium image, and challengers from emerging markets offer cost-effective options. Technology leadership, affordability, and access to charging infrastructure are key determinants of market share. New trends like advanced battery technology, V2G integration, and innovative ownership models offer exciting opportunities for growth. To succeed in this electrifying race, players must embrace innovation, prioritize sustainability, and cater to the evolving needs of environmentally conscious consumers.

Industry Developments and Latest Updates:

Top Companies in the Automotive Low Emission Vehicle industry includes,

Tesla, Inc. (U.S.):

- December 21, 2023: Tesla delivers record 405,278 vehicles in Q4 2023, exceeding prior guidance. (Source: Tesla Investor Relations)

BMW AG (Germany):

- December 11, 2023: BMW announces plans to invest €30 billion in electric vehicles and battery production by 2025. (Source: Reuters)

Isuzu Motors Ltd. (Japan):

- September 12, 2023: Isuzu and Toyota partner to develop hydrogen fuel cell trucks. (Source: Nikkei Asia)

Nissan Motor Company Ltd (Japan):

- December 19, 2023: Nissan and Renault announce plans to jointly develop and manufacture electric vehicles (EVs) in Mexico. (Source: Nikkei Asia)