Regulatory Support and Incentives

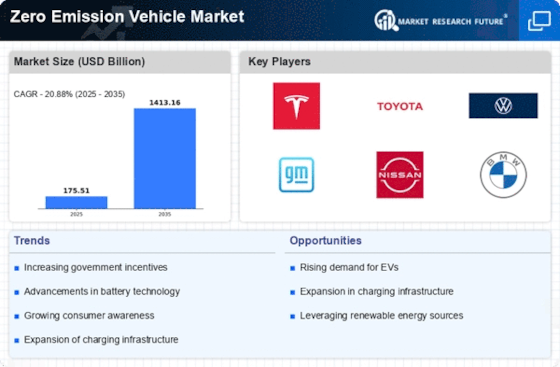

The Zero Emission Vehicle Market is experiencing a surge in regulatory support and incentives from various governments. These initiatives often include tax credits, rebates, and grants aimed at both manufacturers and consumers. For instance, many regions have set ambitious targets for reducing greenhouse gas emissions, which necessitates a shift towards zero-emission vehicles. In 2025, several countries are expected to implement stricter emissions standards, further propelling the demand for electric and hydrogen-powered vehicles. This regulatory landscape not only encourages manufacturers to innovate but also makes zero-emission vehicles more financially accessible to consumers. As a result, the Zero Emission Vehicle Market is likely to witness accelerated growth, driven by favorable policies that align with environmental goals.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are increasingly influencing the Zero Emission Vehicle Market. Many companies are committing to reducing their carbon footprints and are integrating zero-emission vehicles into their fleets as part of their sustainability strategies. By 2025, a growing number of corporations are expected to adopt electric vehicles for logistics and employee transportation, driven by both regulatory pressures and consumer expectations. This shift not only enhances corporate image but also contributes to long-term cost savings through reduced fuel expenses and maintenance. As businesses prioritize sustainability, the demand for zero-emission vehicles is likely to rise, further propelling the growth of the Zero Emission Vehicle Market. This trend reflects a broader societal shift towards environmentally responsible practices.

Consumer Demand for Sustainable Transportation

Consumer demand for sustainable transportation options is a significant driver of the Zero Emission Vehicle Market. As awareness of climate change and environmental issues grows, more consumers are seeking vehicles that align with their values. By 2025, surveys indicate that a substantial percentage of potential car buyers prioritize eco-friendly options, influencing their purchasing decisions. This shift in consumer behavior is prompting manufacturers to expand their zero-emission vehicle offerings, including a wider range of models and price points. Additionally, the increasing availability of information regarding the benefits of zero-emission vehicles is likely to further educate consumers. As a result, the Zero Emission Vehicle Market is expected to flourish, driven by a consumer base that is increasingly committed to sustainability.

Technological Advancements in Battery Technology

Technological advancements in battery technology are playing a pivotal role in the Zero Emission Vehicle Market. Innovations such as solid-state batteries and improved lithium-ion technologies are enhancing energy density and reducing charging times. As of 2025, the average range of electric vehicles is projected to exceed 300 miles on a single charge, addressing one of the primary consumer concerns regarding range anxiety. Furthermore, the cost of battery production has been declining, which is expected to lower the overall price of electric vehicles. This trend not only makes zero-emission vehicles more appealing to consumers but also encourages manufacturers to invest in research and development. Consequently, the Zero Emission Vehicle Market is poised for substantial growth as these technological improvements continue to evolve.

Growing Infrastructure for Charging and Refueling

The expansion of infrastructure for charging and refueling is a critical driver for the Zero Emission Vehicle Market. As of 2025, the number of public charging stations is anticipated to increase significantly, making it more convenient for consumers to own and operate zero-emission vehicles. This growth is supported by both private investments and government initiatives aimed at enhancing the availability of charging networks. Additionally, advancements in fast-charging technology are likely to reduce the time required to recharge electric vehicles, further encouraging adoption. The availability of hydrogen refueling stations is also expanding, catering to fuel cell vehicles. This infrastructure development is essential for alleviating consumer concerns about range and accessibility, thereby fostering a more robust Zero Emission Vehicle Market.