Research Methodology on Zero Energy Buildings Market

Objectives of the Research

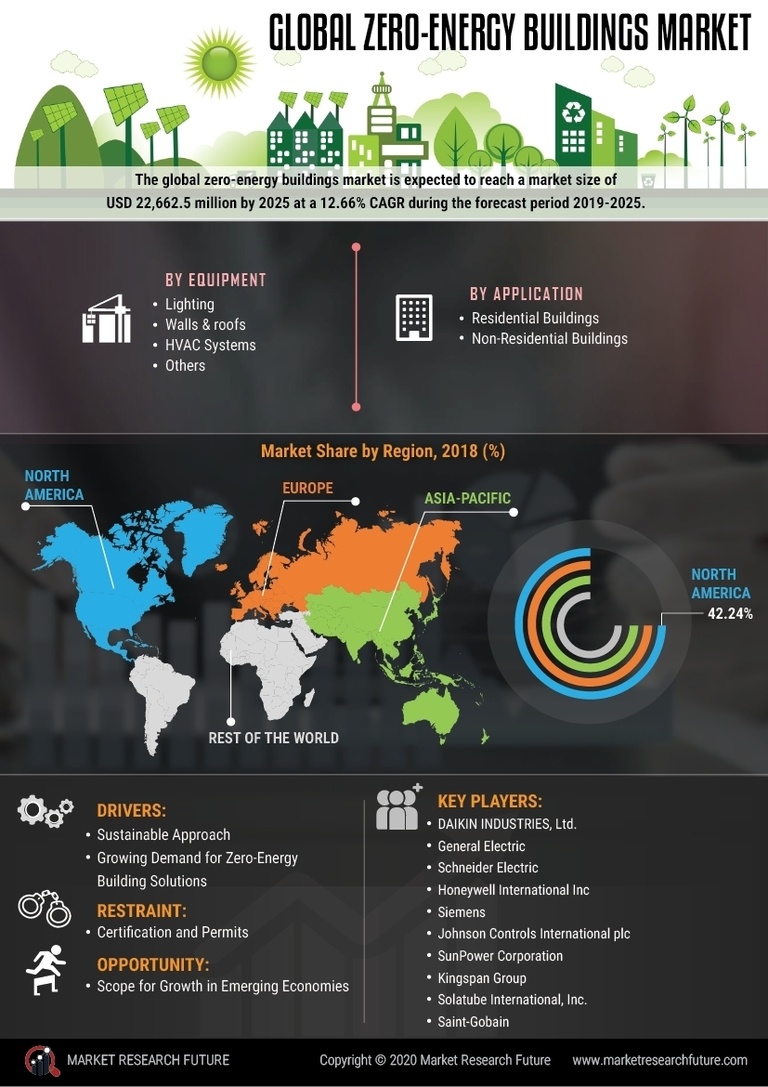

This research aims to assess the current market conditions of zero-energy buildings in order to gain insights into factors such as market size, product trends, key industry players, construction material usage, and demand drivers.

Scope of the Study

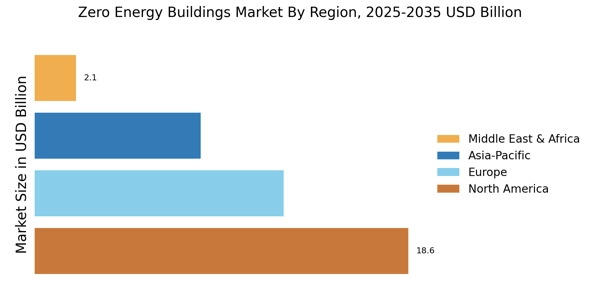

This research studied the current market trends of zero-energy buildings, covering their demand in North America, Europe, Asia-Pacific, and the Rest of the World regions. The focus is mainly on net-zero energy buildings but includes additional information on positive-energy buildings.

Research Design

The research followed an exploratory research design approach, using both qualitative and quantitative data. Qualitative data was collected through desk research, secondary sources, and interviews with industry participants. Questionnaires were also sent out to participants in order to collect more detailed information about the market. Quantitative data was collected through primary market analysis and market size estimation.

Data Sources

Primary sources included industry experts, suppliers, distributors, manufacturers, and trade associations. Secondary sources included reports, industry white papers, websites, and press releases that are related to the market. Relevant databases and archives were also used to supplement the research.

Data Collection

Primary data was collected through interviews with industry participants and surveys. Secondary data was collected through desk research and market reports. Data was collected in such a way as to make sure that data was both reliable and accurate.

Data Analysis

Data is analyzed in order to gain insights into the market. It is analyzed using a combination of qualitative and quantitative methods, including factor analysis, correlation analysis, and regression analysis. Data is further analyzed to draw meaningful conclusions about the market.

Market Forecast

Market size and forecast for 2023 to 2030 were done using the data gathered through primary and secondary research. Market size estimation was done by considering key market factors such as production capacity, demand, and regulatory requirements. Forecasting was done using the qualitative data collected from industry experts and quantitative data collected from the surveys and interviews.

Assumptions

The market analysis and forecast were done with the following assumptions:

-

The demand for zero-energy buildings is expected to increase in the coming years due to the increasing focus on sustainability.

-

Key industry players are investing heavily in research and development in order to increase construction efficiency and reduce operational costs.

-

Demand for green building materials and energy-efficient technologies is on the rise due to increasing awareness of environmental concerns.

-

The market is expected to be driven by government incentives such as tax credits and subsidies.

-

Manufacturers and suppliers are expected to face strict regulations on product quality, safety, and environmental consciousness.