Advancements in Battery Technology

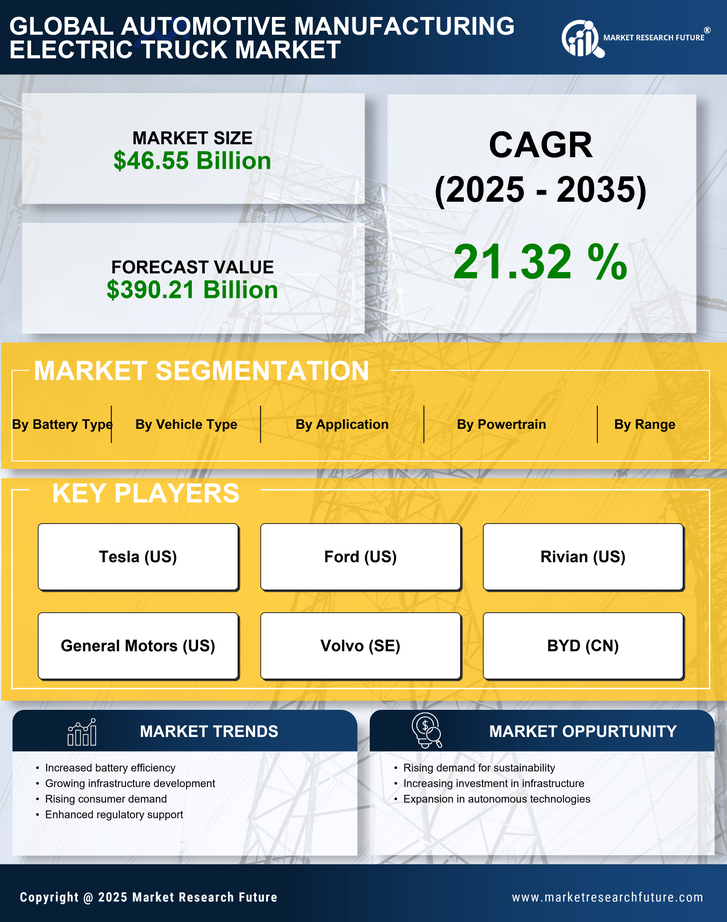

Battery technology advancements are playing a pivotal role in the Automotive Manufacturing Electric Truck Market. Innovations in lithium-ion batteries, such as increased energy density and reduced charging times, are likely to enhance the performance and appeal of electric trucks. As of 2025, the average range of electric trucks is projected to exceed 300 miles on a single charge, making them more competitive with traditional diesel trucks. Furthermore, the development of solid-state batteries may revolutionize the industry by offering greater safety and efficiency. These technological improvements could lead to a broader acceptance of electric trucks among fleet operators and individual consumers, thereby driving market growth.

Investment in Charging Infrastructure

Investment in charging infrastructure is crucial for the growth of the Automotive Manufacturing Electric Truck Market. The expansion of charging networks is essential to alleviate range anxiety among potential electric truck users. As of 2025, significant investments are being made in fast-charging stations and depot charging solutions, which could facilitate the widespread adoption of electric trucks. This infrastructure development is likely to enhance the practicality of electric trucks for long-haul operations, making them a viable alternative to traditional trucks. Consequently, the availability of robust charging infrastructure may serve as a catalyst for increased market penetration and consumer acceptance of electric trucks.

Rising Fuel Prices and Economic Factors

The Automotive Manufacturing Electric Truck Market is also influenced by rising fuel prices and economic factors. As fuel costs continue to escalate, businesses are increasingly seeking cost-effective alternatives to traditional fuel-powered trucks. Electric trucks, with their lower operating costs and reduced maintenance requirements, present a compelling solution. In 2025, it is anticipated that the total cost of ownership for electric trucks will become more favorable compared to their diesel counterparts, further incentivizing fleet operators to transition to electric options. This economic shift may catalyze a significant increase in demand for electric trucks, thereby propelling the market forward.

Regulatory Support for Electric Vehicles

The Automotive Manufacturing Electric Truck Market is experiencing a surge in regulatory support aimed at promoting electric vehicles. Governments are implementing stringent emissions standards and offering incentives for electric truck production. For instance, various regions have established tax credits and rebates for manufacturers and consumers alike, which could potentially enhance market penetration. In 2025, it is estimated that regulatory frameworks will continue to evolve, further encouraging manufacturers to invest in electric truck technologies. This supportive environment may lead to increased production capacities and innovation within the industry, as companies strive to meet compliance requirements while also appealing to environmentally conscious consumers.

Consumer Demand for Sustainable Solutions

Consumer demand for sustainable solutions is a driving force in the Automotive Manufacturing Electric Truck Market. As awareness of environmental issues grows, consumers are increasingly favoring products that align with their values. Electric trucks, which produce zero tailpipe emissions, are becoming more attractive to both individual buyers and businesses aiming to enhance their sustainability profiles. By 2025, it is expected that a substantial portion of consumers will prioritize eco-friendly options when making purchasing decisions. This shift in consumer behavior could lead to a marked increase in electric truck sales, compelling manufacturers to expand their offerings and innovate further in this space.