Market Share

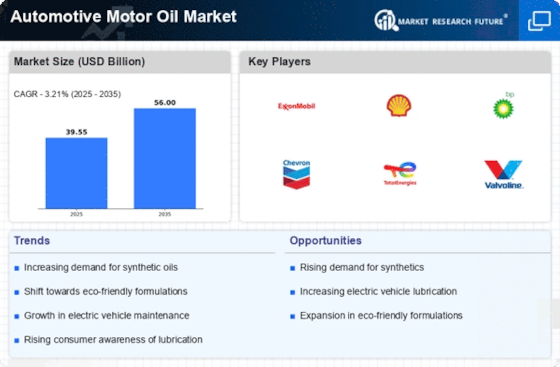

Automotive Motor Oil Market Share Analysis

The competitive position of companies in the industry is significantly affected by strategies of market share positioning, which are essential determinants in the dynamic nature of the Automotive Motor Oil Market. These strategies must be employed by businesses to establish and maintain a competitive advantage in the emerging technologies, changing customer tastes, and government policies. One such strategy that firms often follow is product differentiation. In order to be distinct, businesses divert huge funds towards research and development so as to produce motor oils that have different formulas, additives or even performance levels. In this way stimulating customers’ interest through some attributes like better gas mileage, longer-lasting engines etc., enables the company to win more clients hence greater market share than competitors.

Another way relates to price settings. By setting prices for their motor oils strategically firms can serve various sections within the market. Some choose premium pricing where they put their oil as high quality technological items that justify higher rates. On the other hand, others sell low priced motor oils targeting those buyers who focus on price first while making purchases like cost conscious consumers. This helps to align prices with perceived value of goods while at the same time satisfying financial expectations of target markets.

Brand positioning constitutes another important factor in market share strategies. Thus it is significant for organizations to create a positive brand image capable of attracting prospective purchasers.A lot companies therefore require marketing and branding activities so as to build distinctive identities among consumers.Strengths such as reliability or innovation or environmental consciousness associated with specific brands may give them significant edges over rivals.For example, branding also promotes customer loyalty which makes them come back for more products from that company or take others there thus increasing sales volumes leading to higher market shares.

Also relevant are distribution channels towards determining one’s shares as well as positioning on a certain market level among top players in automotive lubricant business world-wise if not regionally only covering domestic countries across the globe.A good number of businesses prefer traditional retail outlets while others go online using e-commerce platforms due to rise of internet shopping channel. Distribution networks are vital in terms of the efficiency and effectiveness that enhance or deter a company’s ability to make its products available to consumers thus affecting market stake.

Finally, strategic alliances and partnerships are other factors, which contribute towards optimization of business position within the market. In this case, firms create ties with vehicle manufacturers, service centres or any other firm operating in this industry in order to gain visibility and penetrate into markets. Trustworthy partners offer a company both credibility and clientele base that can be used as an upper edge towards increasing one’s share in the market.

Leave a Comment