Integration with IoT Ecosystems

The Automotive NFC Market is increasingly integrating with Internet of Things (IoT) ecosystems, creating new opportunities for enhanced vehicle functionality. As vehicles become part of a larger network of connected devices, NFC technology facilitates communication between vehicles and smart infrastructure, enabling features such as real-time traffic updates and remote diagnostics. The IoT market is projected to grow exponentially, with estimates indicating it could reach over 1 trillion dollars by 2025. This integration not only enhances the driving experience but also positions the Automotive NFC Market as a key player in the evolving landscape of connected technologies.

Increased Focus on Vehicle Security

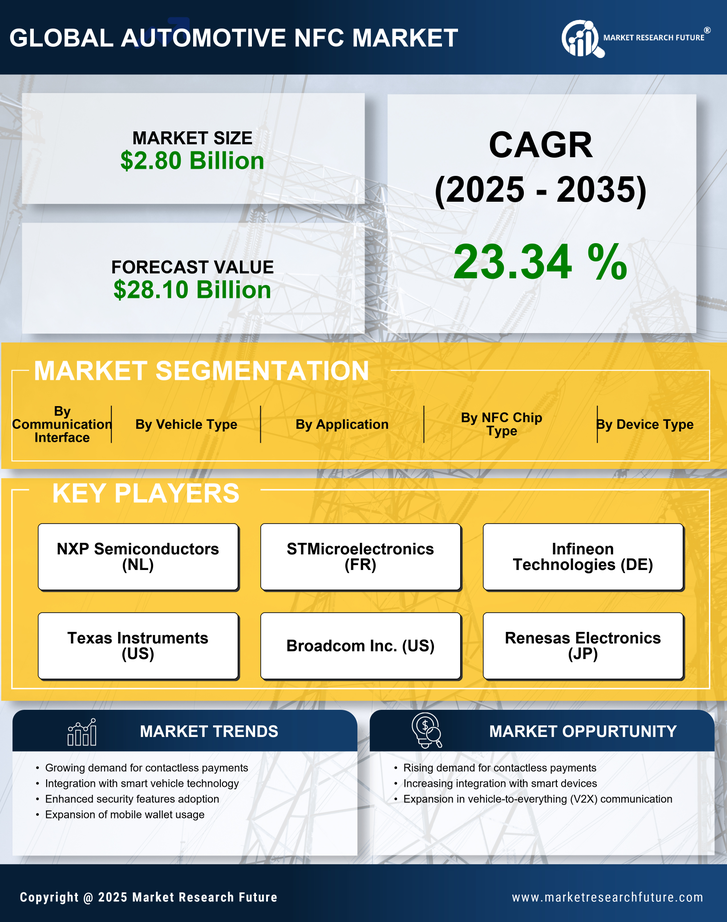

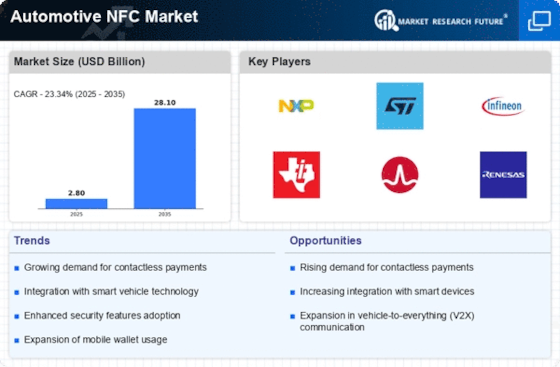

The Automotive NFC Market is witnessing a heightened emphasis on security features, particularly in the context of vehicle access and data protection. As cyber threats become more sophisticated, manufacturers are incorporating NFC technology to bolster security measures, such as secure authentication for keyless entry systems. Data suggests that The Automotive NFC Market is anticipated to grow significantly, potentially reaching over 30 billion dollars by 2026. This focus on security not only addresses consumer concerns but also drives innovation within the Automotive NFC Market, as companies strive to develop more secure and reliable NFC solutions.

Advancements in Vehicle Connectivity

The Automotive NFC Market is being propelled by rapid advancements in vehicle connectivity technologies. As vehicles become more interconnected, the integration of NFC technology allows for enhanced communication between devices, enabling features such as keyless entry and personalized settings. Reports indicate that the connected car market is expected to reach substantial figures, with projections estimating it to surpass 200 billion dollars by 2025. This growth in connectivity not only enhances user experience but also fosters the adoption of NFC solutions, thereby contributing to the expansion of the Automotive NFC Market.

Growing Adoption of Smart Key Systems

The Automotive NFC Market is benefiting from the growing adoption of smart key systems, which utilize NFC technology to enhance user convenience and vehicle access. These systems allow users to unlock and start their vehicles with a simple tap of their smartphones or NFC-enabled devices. Market analysis indicates that the smart key segment is projected to grow at a robust pace, with estimates suggesting a market size exceeding 10 billion dollars by 2025. This trend reflects a shift towards more user-friendly solutions in the Automotive NFC Market, as consumers seek innovative ways to interact with their vehicles.

Rising Demand for Contactless Payments

The Automotive NFC Market is experiencing a notable surge in demand for contactless payment solutions. As consumers increasingly prefer seamless transactions, automotive manufacturers are integrating NFC technology into vehicles to facilitate easy payments for fuel, tolls, and parking. This trend is supported by data indicating that the contactless payment segment is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. The convenience offered by NFC-enabled vehicles aligns with consumer expectations for efficiency and speed, thereby driving the Automotive NFC Market forward.