Enhanced Vehicle Performance

The quest for improved vehicle performance is a significant driver for the Automotive Non-contact Temperature Sensor Market. These sensors facilitate precise temperature measurements, which are vital for optimizing engine performance and fuel efficiency. By enabling real-time monitoring of critical components, manufacturers can fine-tune engine parameters, leading to enhanced power output and reduced emissions. The automotive sector is increasingly focusing on sustainability, and non-contact temperature sensors contribute to this goal by ensuring that vehicles operate within optimal temperature ranges. This trend is likely to bolster the demand for such sensors in high-performance and luxury vehicles.

Regulatory Compliance and Standards

Stringent regulations regarding vehicle emissions and safety standards are driving the Automotive Non-contact Temperature Sensor Market. Governments worldwide are implementing policies that require manufacturers to adopt advanced technologies to meet these standards. Non-contact temperature sensors are integral to ensuring compliance, as they provide accurate data for emissions control systems and safety mechanisms. The automotive industry is witnessing a shift towards more rigorous testing and validation processes, which further emphasizes the need for reliable temperature monitoring solutions. As regulations evolve, the demand for non-contact temperature sensors is expected to rise, aligning with industry compliance requirements.

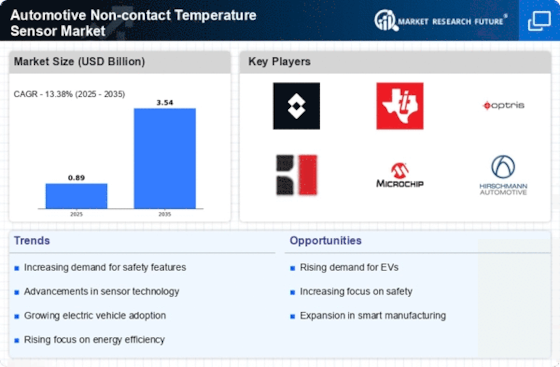

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Automotive Non-contact Temperature Sensor Market. As manufacturers strive to enhance battery efficiency and safety, non-contact temperature sensors play a crucial role in monitoring battery temperatures. This technology helps prevent overheating, thereby extending battery life and improving overall vehicle performance. According to recent data, the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This surge in EV production necessitates advanced thermal management solutions, positioning non-contact temperature sensors as essential components in modern automotive design.

Growing Focus on Autonomous Vehicles

The development of autonomous vehicles is significantly influencing the Automotive Non-contact Temperature Sensor Market. As vehicles become increasingly automated, the need for sophisticated sensor technologies grows. Non-contact temperature sensors are essential for monitoring various systems, including battery management and thermal regulation in autonomous driving systems. The integration of these sensors enhances the safety and reliability of self-driving vehicles, which is paramount for consumer acceptance. With the autonomous vehicle market projected to expand rapidly, the demand for non-contact temperature sensors is likely to increase, driven by the need for advanced thermal management solutions.

Technological Innovations in Sensor Design

Innovations in sensor technology are propelling the Automotive Non-contact Temperature Sensor Market forward. Advances in materials science and sensor design are leading to the development of more accurate, reliable, and cost-effective non-contact temperature sensors. These innovations enable manufacturers to integrate sensors into a wider range of applications, from engine monitoring to passenger comfort systems. The trend towards miniaturization and increased functionality is also noteworthy, as it allows for seamless integration into modern vehicle architectures. As automotive technology continues to evolve, the demand for innovative non-contact temperature sensors is expected to grow, reflecting the industry's commitment to enhancing vehicle performance and safety.