Customization Trends

Customization trends are significantly impacting the Automotive OEM Coatings Market. Consumers are increasingly seeking personalized vehicles that reflect their individual styles and preferences. This demand for customization is prompting manufacturers to offer a wider range of color options, finishes, and textures in their coatings. In 2025, it is anticipated that the customization segment will represent around 25% of the overall market. This trend not only enhances customer satisfaction but also drives sales, as unique coatings can differentiate brands in a competitive market. Consequently, automotive manufacturers are investing in flexible production processes to accommodate these customization requests.

Regulatory Compliance

Regulatory compliance is a critical driver in the Automotive OEM Coatings Market. Governments worldwide are implementing stringent regulations regarding emissions and environmental standards, compelling manufacturers to adopt compliant coating solutions. The introduction of regulations such as the European Union's REACH and the U.S. EPA's VOC standards has led to a shift towards low-emission and eco-friendly coatings. By 2025, it is expected that compliance-related investments will account for a significant portion of R&D budgets in the automotive sector. This focus on regulatory compliance not only ensures market access but also enhances the reputation of manufacturers committed to sustainability.

Technological Innovations

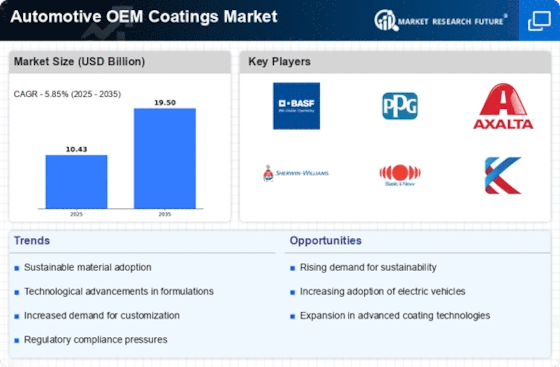

Technological innovations play a pivotal role in shaping the Automotive OEM Coatings Market. Advancements in coating technologies, such as nanotechnology and advanced polymer formulations, are enhancing the performance and durability of automotive coatings. These innovations lead to improved scratch resistance, UV protection, and corrosion resistance, which are critical for maintaining vehicle aesthetics and longevity. In 2025, the market for advanced coatings is projected to grow at a CAGR of 5%, driven by the increasing demand for high-performance coatings. Furthermore, the integration of smart coatings that can change color or self-heal is expected to revolutionize the industry, offering new opportunities for manufacturers.

Sustainability Initiatives

The Automotive OEM Coatings Market is increasingly influenced by sustainability initiatives. Manufacturers are adopting eco-friendly coatings that reduce environmental impact. This shift is driven by stringent regulations aimed at minimizing volatile organic compounds (VOCs) and promoting the use of water-based coatings. In 2025, it is estimated that the demand for sustainable coatings will account for approximately 30% of the total market share. This trend not only aligns with consumer preferences for greener products but also enhances the brand image of automotive manufacturers. As a result, companies are investing in research and development to create innovative, sustainable coating solutions that meet both regulatory requirements and consumer expectations.

Growing Automotive Production

The growing automotive production is a fundamental driver of the Automotive OEM Coatings Market. As vehicle production ramps up, the demand for high-quality coatings that provide protection and aesthetic appeal increases correspondingly. In 2025, global automotive production is projected to reach approximately 90 million units, which will directly influence the coatings market. This surge in production necessitates innovative coating solutions that can withstand various environmental conditions while meeting consumer expectations for durability and appearance. Consequently, manufacturers are focusing on developing coatings that not only enhance vehicle performance but also align with the latest design trends.