Environmental Regulations

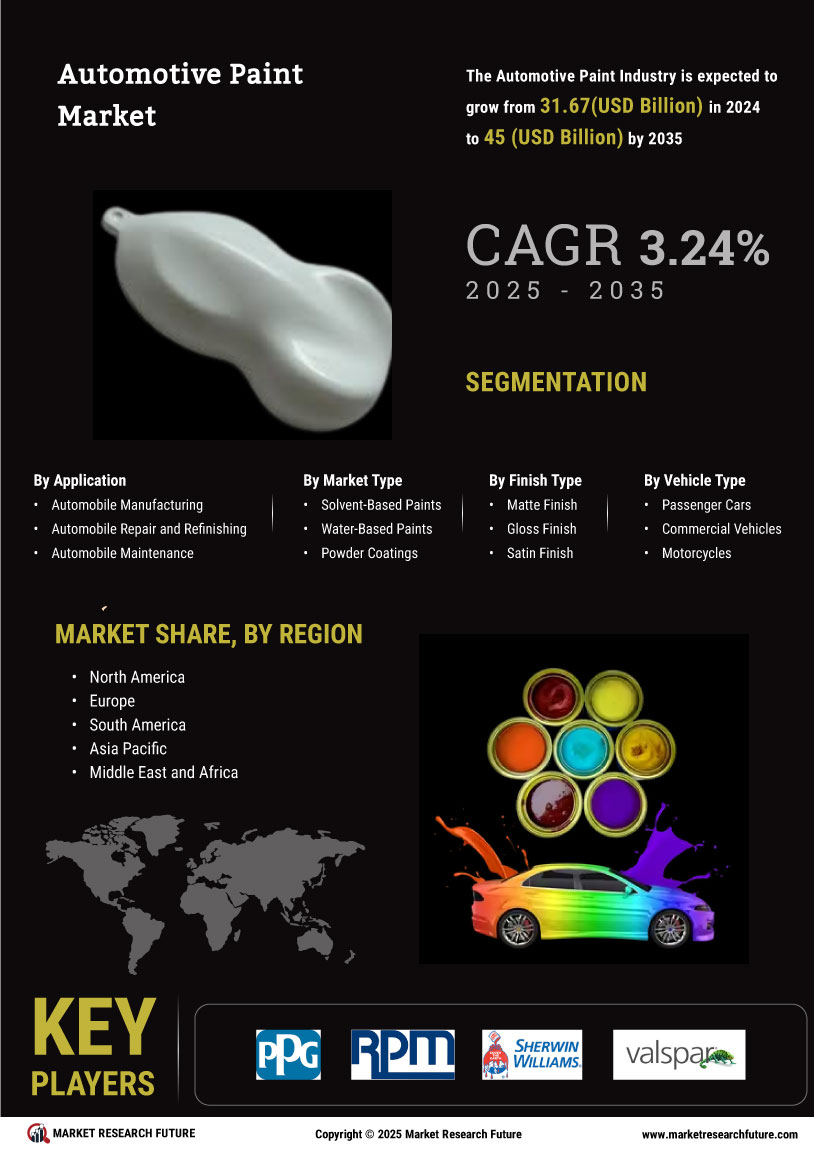

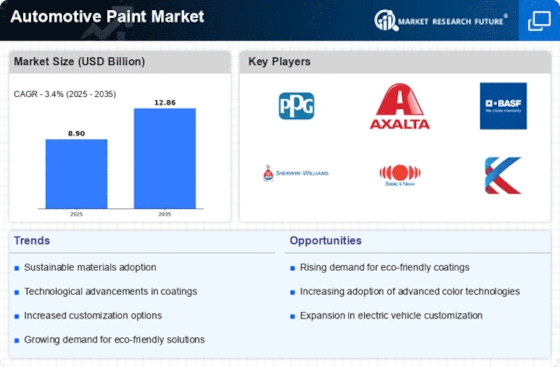

The Automotive Paint Market is significantly influenced by stringent environmental regulations aimed at reducing volatile organic compounds (VOCs) emissions. Governments worldwide are implementing policies that mandate the use of eco-friendly paint formulations, which has led to a shift towards water-based and low-VOC paints. This transition not only aligns with sustainability goals but also opens new avenues for growth within the Automotive Paint Market. As of 2025, it is estimated that the demand for environmentally compliant automotive paints will account for over 40% of the total market share, reflecting a growing consumer preference for sustainable products.

Rising Vehicle Production

The Automotive Paint Market is experiencing a notable surge due to the increasing production of vehicles. As manufacturers ramp up their output to meet consumer demand, the need for high-quality automotive paint becomes paramount. In 2025, the production of passenger cars is projected to reach approximately 70 million units, which directly correlates with the demand for automotive paint. This growth is driven by factors such as urbanization and rising disposable incomes, leading to a greater number of vehicles on the road. Consequently, the Automotive Paint Market is poised for expansion as manufacturers seek innovative and durable paint solutions to enhance vehicle aesthetics and longevity.

Growth of Electric Vehicles

The rise of electric vehicles (EVs) is emerging as a pivotal driver for the Automotive Paint Market. As manufacturers invest heavily in EV production, there is a corresponding demand for specialized coatings that cater to the unique requirements of electric vehicles. These paints often require advanced thermal management properties and enhanced durability to withstand varying environmental conditions. By 2025, it is anticipated that the EV segment will account for approximately 25% of total vehicle sales, thereby significantly impacting the Automotive Paint Market. This shift presents opportunities for paint manufacturers to innovate and develop tailored solutions for the evolving automotive landscape.

Customization Trends Among Consumers

The Automotive Paint Market is witnessing a growing trend towards customization and personalization among consumers. As vehicle owners increasingly seek unique finishes and colors to reflect their individual styles, the demand for specialized automotive paints is on the rise. This trend is particularly pronounced in the luxury and aftermarket segments, where consumers are willing to invest in high-quality, bespoke paint solutions. In 2025, it is projected that the customization segment will contribute to a 15% increase in the overall market size of the Automotive Paint Market. This shift underscores the importance of offering diverse color palettes and finishes to meet consumer preferences.

Technological Innovations in Coatings

Technological advancements in coating technologies are reshaping the Automotive Paint Market. Innovations such as nanotechnology and advanced polymer formulations are enhancing the performance characteristics of automotive paints, including durability, scratch resistance, and color retention. In 2025, the market for advanced coatings is expected to grow at a compound annual growth rate of 6%, driven by the automotive sector's need for high-performance solutions. These innovations not only improve the aesthetic appeal of vehicles but also contribute to their longevity, thereby increasing the overall demand within the Automotive Paint Market.