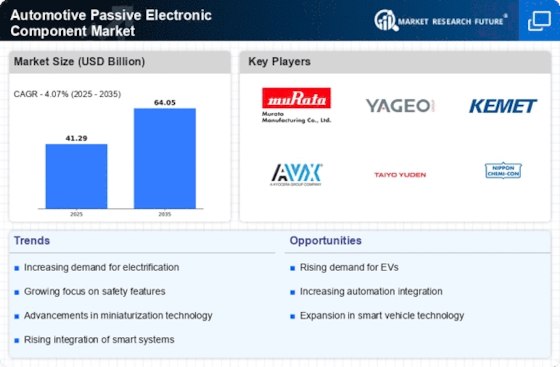

Growth of Electric and Hybrid Vehicles

The Automotive Passive Electronic Component Market is poised for growth due to the increasing adoption of electric and hybrid vehicles. These vehicles require a range of passive electronic components to manage power distribution, energy storage, and thermal management. As manufacturers transition towards electrification, the demand for capacitors, inductors, and other passive components is expected to rise. Recent data indicates that the electric vehicle market is anticipated to reach a valuation of several hundred billion dollars by the end of the decade. This shift towards electrification not only enhances vehicle performance but also necessitates a robust supply chain for passive electronic components, thereby creating opportunities for industry players.

Regulatory Compliance and Safety Standards

The Automotive Passive Electronic Component Market is also driven by stringent regulatory compliance and safety standards imposed by various authorities. As governments worldwide implement more rigorous safety regulations, automotive manufacturers are compelled to enhance the reliability and performance of their vehicles. This necessitates the use of high-quality passive electronic components that can withstand extreme conditions and ensure optimal functionality. For instance, components used in safety-critical applications must meet specific performance criteria, which in turn boosts the demand for reliable passive components. The ongoing evolution of safety standards is likely to create a sustained demand for these components in the automotive sector.

Rising Consumer Expectations for Vehicle Performance

The Automotive Passive Electronic Component Market is witnessing a shift in consumer expectations regarding vehicle performance and features. Modern consumers increasingly demand vehicles that offer enhanced performance, fuel efficiency, and advanced technological features. This trend is driving automotive manufacturers to invest in high-quality passive electronic components that can support these performance enhancements. As a result, the market for passive components is expected to grow, with estimates indicating a potential increase in demand by several billion dollars over the next few years. The need for components that can improve vehicle dynamics and overall user experience is likely to shape the future landscape of the automotive passive electronic component market.

Technological Advancements in Automotive Electronics

The Automotive Passive Electronic Component Market is significantly influenced by rapid technological advancements in automotive electronics. Innovations such as improved semiconductor materials and miniaturization techniques are enhancing the performance and efficiency of passive components. These advancements enable the development of more compact and reliable electronic systems, which are crucial for modern vehicles. As automotive manufacturers increasingly incorporate sophisticated electronic features, the demand for high-quality passive components is likely to escalate. Market analysts suggest that the trend towards smart vehicles, equipped with advanced connectivity and automation features, will further propel the need for innovative passive electronic solutions.

Increasing Demand for Advanced Driver Assistance Systems

The Automotive Passive Electronic Component Market is experiencing a surge in demand for advanced driver assistance systems (ADAS). These systems, which enhance vehicle safety and convenience, rely heavily on passive electronic components such as capacitors and resistors. As automotive manufacturers strive to meet stringent safety regulations, the integration of ADAS is becoming more prevalent. In fact, the market for ADAS is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is likely to drive the demand for passive components, as they are essential for the functionality of various sensors and control units within these systems.