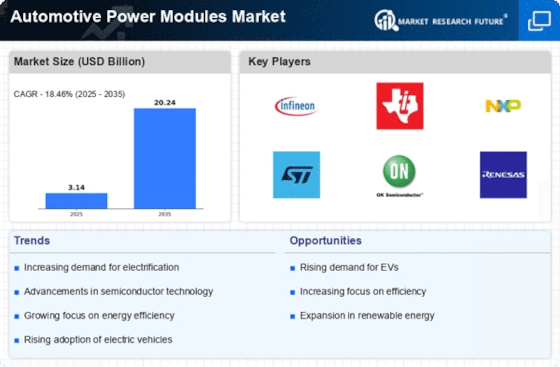

Growing Focus on Energy Efficiency

The increasing emphasis on energy efficiency in the automotive sector is a significant driver for the Automotive Power Modules Market. As consumers become more environmentally conscious, the demand for vehicles that minimize energy consumption is rising. Automotive manufacturers are responding by integrating advanced power modules that optimize energy use and enhance overall vehicle performance. In 2025, it is projected that energy-efficient vehicles will account for over 40% of total vehicle sales, underscoring the importance of power modules in achieving these efficiency targets. This trend not only benefits consumers through reduced operating costs but also aligns with global sustainability goals, further propelling the Automotive Power Modules Market.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver of the Automotive Power Modules Market. As governments worldwide implement stringent emission regulations, the shift towards EVs accelerates. In 2025, the market for electric vehicles is projected to reach approximately 30 million units, significantly boosting the demand for automotive power modules. These modules are essential for managing power distribution and enhancing the efficiency of electric drivetrains. Consequently, manufacturers are investing heavily in developing advanced power modules to meet the growing needs of the EV market. This trend indicates a robust growth trajectory for the Automotive Power Modules Market, as the transition to electrification continues to reshape the automotive landscape.

Government Initiatives and Incentives

Government initiatives aimed at promoting sustainable transportation are significantly influencing the Automotive Power Modules Market. Various countries are offering incentives for electric vehicle adoption, including tax rebates and subsidies, which encourage consumers to transition from traditional vehicles to electric alternatives. In 2025, it is anticipated that these initiatives will lead to a 25% increase in electric vehicle sales, thereby driving demand for automotive power modules. Furthermore, regulatory frameworks are being established to support the development of charging infrastructure, which is essential for the widespread adoption of EVs. This supportive environment fosters growth in the Automotive Power Modules Market, as manufacturers align their strategies with governmental policies.

Technological Advancements in Power Electronics

Technological innovations in power electronics are propelling the Automotive Power Modules Market forward. The development of wide bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), enhances the performance and efficiency of power modules. These materials allow for higher operating temperatures and voltages, which are crucial for modern electric and hybrid vehicles. As of 2025, the market for power electronics in automotive applications is expected to exceed USD 10 billion, reflecting the growing reliance on advanced power modules. This evolution in technology not only improves energy efficiency but also reduces the overall size and weight of power modules, making them more attractive to manufacturers and consumers alike.

Integration of Advanced Driver Assistance Systems (ADAS)

The integration of Advanced Driver Assistance Systems (ADAS) is emerging as a crucial driver for the Automotive Power Modules Market. As vehicles become increasingly equipped with sophisticated safety and automation features, the demand for reliable power modules that can support these technologies grows. ADAS applications require robust power management solutions to ensure optimal performance and safety. By 2025, it is estimated that the market for ADAS will surpass USD 30 billion, creating substantial opportunities for power module manufacturers. This integration not only enhances vehicle safety but also contributes to the overall advancement of autonomous driving technologies, thereby reinforcing the significance of the Automotive Power Modules Market in the evolving automotive landscape.