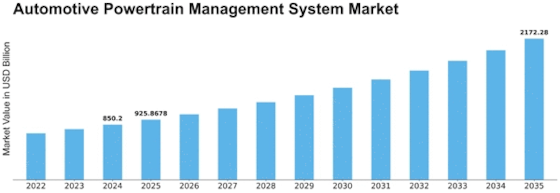

Automotive Powertrain Management System Size

Automotive Powertrain Management System Market Growth Projections and Opportunities

The Automotive Powertrain Management System market is experiencing dynamic changes, which are being driven by forces of a dynamic market and technological advancements. The automotive industry plays an integral role in this sector because it requires powertrain systems, which ensures that there is power delivery to the wheel of the vehicle. Regulatory requirements, consumer preferences and advancement in automotive technologies are examples of some of the elements that shape market dynamics within Automotive Powertrain Management System. There is growing stringency in emission norms all over the world and this represents one key driver behind how the markets are evolving. Governments around the world have become more stringent about their policies on emissions so as to safeguard the environment and promote sustainable transportation. As a result, auto producers find themselves under pressure to develop fuel efficient powertrain management systems that will also reduce emissions. Consequently, there has been a rise in demand for sophisticated power train technologies such as hybrid and electric drives leading to innovation and development within these sectors. Another crucial factor influencing market dynamics is increased consumer preference towards cleaner and more fuel-efficient vehicles. This is due to increased awareness about environmental concerns coupled with an upsurge in sustainable practices wherein consumers prefer vehicles that demonstrate eco-friendly values. This change in buyer behavior has made auto manufacturers heavily invest on R&D of PBMSs that not only meet performance but also contribute to reduced carbon footprint. Apart from this, market dynamics are determined by changing landscape on self-driving automobiles. Powertrain management is more important in autonomies as compared to conventional cars. For autonomous vehicles to operate seamlessly, there must be an effective communication and control among various components and systems while powertrain management system is in the central position of ensuring that this happens.

The globalized and interconnected nature of today’s economies has also impacted the dynamics within the Automotive Powertrain Management System market. The trend in the industry is now shifting towards collaboration and partnership between major players, who are pooling their resources together for mutual benefit. By reducing time-to-market, fostering innovation and improving overall competitiveness of powertrain management systems, this collaborative approach helps. In summary, extensive regulations by governments; consumer preferences; development of new technologies in the field as well as partnerships with OEMs are some factors influencing changes experienced within Automotive Powertrain Management Systems market presently. Power train management systems will therefore shape the future automotive world as we know it. They should be designed for efficiency, high performance while keeping them environmentally friendly at all times. Adaptation strategies against such shifts will define either success or failure of this volatile market with respect to rapid changes happening along automobile sector transformation.

Leave a Comment