Top Industry Leaders in the Automotive Propeller Shaft Market

*Disclaimer: List of key companies in no particular order

*Disclaimer: List of key companies in no particular order

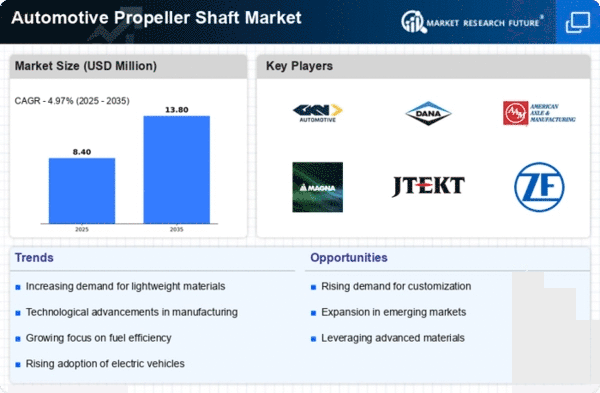

Top listed companies in the Automotive Propeller Shaft industry are:

ZF Friedrichshafen AG, American Axle & Manufacturing, Inc, Meritor, Inc., Showa Corporation, GKN plc, Wilson drive shafts, Nexteer Automotive, JTEKT Corporation, Gestamp, Dana Holding Corporation, D & F Propshafts, Bailey Morris Limited, B & F limited, American Axle & Manufacturing Holdings, Inc., and Hyundai Wia Corporation

Bridging the Drive: Exploring the Competitive Landscape of the Automotive Propeller Shaft Market

In the intricate workings of an automobile, a vital silent partner carries the engine's power to the wheels - the propeller shaft. This multi-billion dollar market hums with activity, as established titans, nimble innovators, and regional specialists vie for a share in the technology that bridges the gap between power generation and traction. Let's delve into the key strategies, market dynamics, and future trends shaping this crucial landscape.

Key Player Strategies:

Global Titans: Companies like Dana Incorporated, GKN PLC, and American Axle & Manufacturing leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to major automakers and Tier 1 suppliers, offering advanced propeller shafts made from high-performance materials and boasting optimized designs for diverse transmission layouts. Dana's Spicer Driveshaft series exemplifies their focus on durability and efficiency.

Technology Disruptors: Startups like American Driveline Components and SFI Flex Drives are disrupting the market with innovative materials like carbon fiber and lightweight composites. They cater to performance-oriented enthusiasts and manufacturers seeking weight reduction, offering stiffer and lighter propeller shafts for enhanced handling and fuel economy. SFI Flex Drives' carbon fiber driveshafts showcase their focus on reducing vehicle weight and improving performance.

Cost-Effective Challengers: Chinese manufacturers like Ningbo Fulong and Zhejiang Kaiou are making waves with competitively priced propeller shafts, targeting budget-conscious projects in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Zhejiang Kaiou's driveshaft kits demonstrate their focus on cost-effective power transmission solutions.

Niche Specialists: Companies like Neapco and Meritor excel in specific segments like heavy-duty truck propeller shafts or high-performance racing driveshafts. They leverage their deep understanding of specialized vehicle requirements and offer tailored solutions with features like high torque capacity or vibration dampening. Neapco's heavy-duty driveshafts showcase their focus on robust power transmission for large vehicles.

Factors for Market Share Analysis:

Material Quality and Durability: Utilizing high-strength materials like steel, aluminum, and carbon fiber, ensuring long service life, and offering robust performance under diverse operating conditions are crucial for market success. Companies with high-quality shafts gain an edge.

Technology and Design: Implementing cutting-edge features like single-piece designs, noise reduction technologies, and vibration dampening mechanisms caters to modern engine configurations and improves overall driving experience. Companies leading in innovation stand out.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive projects. Companies offering affordable solutions without compromising on basic functionality gain market share.

Weight and Efficiency: Designing lightweight and compact propeller shafts minimizes space requirements, improves fuel economy, and enhances vehicle handling. Companies prioritizing weight reduction and efficiency gain an edge.

New and Emerging Trends:

Focus on Electric Vehicles: Adapting propeller shaft technology to the needs of electric vehicles (EVs), accommodating high torque transfer from electric motors, and integrating with complex drivetrain layouts presents significant growth opportunities. Companies specializing in EV propeller shaft solutions stand out.

Data-Driven Optimization: Integrating propeller shafts with onboard sensors and vehicle management systems, offering real-time data on torque transfer and shaft vibrations, and enabling predictive maintenance services cater to modern fleet management needs and improve operational efficiency. Companies embracing data-driven solutions gain an edge.

Focus on Sustainability and Lightweight Materials: Utilizing lightweight and recyclable materials like carbon fiber composites, minimizing environmental impact during manufacturing, and promoting sustainable end-of-life practices cater to increasing demand for environmentally conscious automotive solutions. Companies demonstrating sustainability commitment attract ethical investors and regulatory benefits.

Regional Customization and Compliance: Adapting propeller shaft designs and materials to cater to specific regional terrain conditions, adhering to diverse regulatory standards, and offering regional distribution networks attract local automakers and aftermarket suppliers. Companies with strong regional customization capabilities gain market share.

Overall Competitive Scenario:

The automotive propeller shaft market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative materials and designs. Cost-effective challengers cater to budget-conscious buyers, and niche specialists excel in specific applications. Factors like material quality, technology, affordability, and weight play a crucial role in market share analysis. New trends like EV adaptation, data-driven optimization, sustainability, and regional customization offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse transmission layouts and vehicle types, embrace sustainable practices, and explore data-driven solutions. By bridging the drive with precision and adaptability, they can secure a dominant position in this vital automotive landscape.

Latest Company Updates:

American Axle & Manufacturing (AAM): AAM is focusing on expanding its product portfolio for electric vehicles, including lightweight axles and driveshafts for hybrid and plug-in hybrid vehicles. (Source: AAM website, December 2023)

Meritor: Meritor is investing in research and development of electric drivetrains and axle technologies to prepare for the shift towards electric vehicles. (Source: Meritor website, December 2023)

Showa Corporation: Showa is focusing on developing high-performance and fuel-efficient propeller shafts for high-end vehicles. (Source: Showa Corporation website, December 2023)

GKN plc: GKN is investing in lightweight materials and manufacturing technologies for automotive components, including propeller shafts. (Source: GKN website, December 2023)