Growth of the Automotive Industry

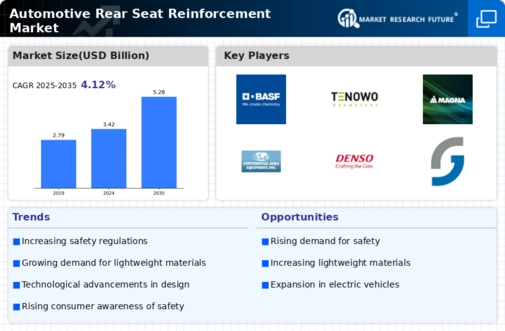

The Automotive Rear Seat Reinforcement Market is poised for growth, driven by the overall expansion of the automotive industry. As vehicle production increases, so does the demand for rear seat reinforcement solutions that ensure passenger safety. The automotive sector is projected to grow at a rate of 4% annually, leading to a corresponding rise in the need for safety features, including rear seat reinforcements. This growth is further fueled by the increasing production of SUVs and larger vehicles, which require more advanced reinforcement technologies to protect passengers effectively. Consequently, manufacturers are likely to focus on developing innovative solutions to cater to this expanding market.

Technological Advancements in Materials

Technological advancements in materials are significantly influencing the Automotive Rear Seat Reinforcement Market. The introduction of high-strength steel and composite materials has enabled manufacturers to create lighter yet more robust rear seat reinforcements. These innovations not only enhance passenger safety but also contribute to overall vehicle weight reduction, which is crucial for improving fuel efficiency. The market for lightweight materials is expected to reach USD 200 billion by 2026, indicating a strong shift towards integrating these materials in automotive design. As manufacturers strive to meet both safety and environmental standards, the demand for advanced materials in rear seat reinforcement is likely to increase.

Regulatory Compliance and Safety Standards

The Automotive Rear Seat Reinforcement Market is significantly shaped by regulatory compliance and evolving safety standards. Governments worldwide are implementing stricter regulations regarding vehicle safety, particularly concerning passenger protection in rear seats. These regulations compel manufacturers to enhance their rear seat reinforcement designs to meet safety benchmarks. For instance, the National Highway Traffic Safety Administration has introduced new guidelines that require improved structural integrity in rear seating areas. As a result, the market is witnessing a shift towards more robust reinforcement solutions, which are essential for compliance and consumer trust. This regulatory landscape is expected to drive innovation and investment in the sector.

Rising Consumer Demand for Safety Features

The Automotive Rear Seat Reinforcement Market is experiencing a notable surge in consumer demand for enhanced safety features in vehicles. As awareness of road safety increases, consumers are prioritizing vehicles equipped with advanced safety systems. This trend is reflected in the growing adoption of rear seat reinforcement technologies, which are designed to protect passengers during collisions. According to recent data, the market for automotive safety features is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is likely to drive manufacturers to invest in innovative rear seat reinforcement solutions, ensuring compliance with stringent safety regulations and meeting consumer expectations.

Shift Towards Electric and Autonomous Vehicles

The Automotive Rear Seat Reinforcement Market is undergoing transformation due to the shift towards electric and autonomous vehicles. As automakers pivot to electric vehicle production, the design and engineering of rear seat reinforcements are evolving to accommodate new vehicle architectures. Electric vehicles often feature different weight distributions and safety requirements, necessitating innovative reinforcement solutions. Additionally, the rise of autonomous vehicles introduces new safety considerations, as the design must account for various passenger scenarios. This shift is expected to create opportunities for manufacturers to develop specialized rear seat reinforcement technologies that align with the unique demands of electric and autonomous vehicles, potentially expanding the market significantly.