Market Analysis

In-depth Analysis of Automotive Seat Market Industry Landscape

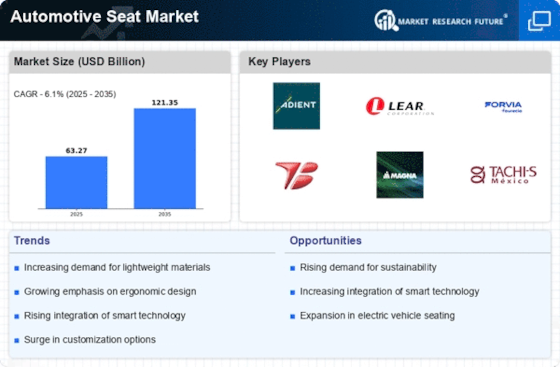

The marketplace dynamics of the automotive seat enterprise showcase a complex interplay of different factors that form its increase and evolution. In recent years, the automotive seat market has undergone tremendous alterations thanks to technological improvements, converting client alternatives, and regulatory requirements. One of the number one drivers influencing this market is the consistent innovation in seat design and materials to beautify comfort, protection, and aesthetics. Furthermore, the global push closer to sustainability and gas efficiency has led to the combination of lightweight materials in automotive seat production. Lightweight seats make contributions now not only to better gas performance but also align with the wider industry trend of lowering the general weight of cars. Safety issues continue to be a critical element in driving market dynamics. Stringent policies and safety standards set through governing bodies around the world have brought automotive seat manufacturers to recognition for incorporating superior safety functions. This includes the development of clever seats prepared with sensors and airbag systems to decorate passenger safety in the event of a collision. As safety guidelines continue to conform, the automotive seat marketplace is likely to witness additional advancements in this area. Geographical and demographic factors additionally contribute appreciably to the marketplace dynamics of automotive seats. Emerging markets with a rising middle class, specifically in Asia-Pacific and Latin America, are witnessing a surge in car sales. This has an instantaneous impact on the demand for automotive seats, as clients in these areas are more and more searching for enhanced comfort and current functions of their vehicles. Additionally, the urbanization trend and the growing want for green transportation solutions are driving the automotive seat market in those regions. Collaborations and partnerships between automotive seat producers and automakers, in addition, form the marketplace dynamics. As the car enterprise undergoes a paradigm shift closer to electric-powered and self-reliant vehicles, seat producers are running intently with automotive agencies to expand specialized seating solutions that cater to the particular requirements of these emerging car kinds. This collaborative approach influences the aggressive landscape and fosters innovation within the automotive seat marketplace. In the end, the marketplace dynamics of the automotive seat enterprise are characterized by a combination of technological advancements, converting consumer alternatives, protection regulations, and global marketplace tendencies. The enterprise's trajectory is likely to be fashioned with the aid of ongoing innovations in substances, design, and safety functions, as well as the evolving panorama of the automobile zone. As client expectations and regulatory standards keep to adapt, automotive seat producers are poised to play an essential function in shaping the future of comfortable, safe, and technologically advanced vehicle seating solutions.

Leave a Comment