Market Trends

Key Emerging Trends in the Automotive Seat Market

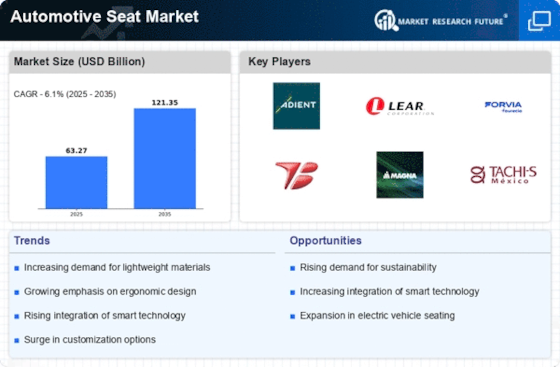

The automotive seat marketplace is undergoing considerable shifts driven by evolving consumer alternatives, technological advancements, and sustainability considerations. In recent years, there has been a substantive move closer to enhancing comfort and protection capabilities in vehicles, immediately impacting the automotive seat market. Consumers are increasingly demanding seats that now not only provide a relaxing riding experience but also contain superior technologies together with heating, cooling, and massage functionalities. One outstanding marketplace trend is the growing focus on lightweight materials and designs to improve gas efficiency and decrease the overall weight of cars. Manufacturers are exploring revolutionary substances like excessive-energy steel, aluminum, and advanced polymers to increase seats that aren't handiest lighter but are additionally durable and eco-friendly. Another key marketplace fashion is the mixing of clever technology in automotive seats. Connectivity capabilities, which include embedded sensors and actuators, allow seats to modify mechanically primarily based on the occupant's options and offer actual-time feedback on posture and health. This now not only complements the general driving enjoyment but additionally contributes to occupant protection with the aid of lowering the hazard of pain-related distractions. In response to environmental issues and rules, there's a developing emphasis on sustainable and green practices in the automotive seat market. Manufacturers are increasingly adopting recyclable materials and eco-friendly manufacturing approaches to align with worldwide sustainability dreams. This shift is not only pushed by using regulatory compliance but also by changing purchaser attitudes towards environmentally conscious merchandise. Additionally, customization has emerged as a widespread element influencing the automotive seat market. Consumers are in search of personalized and specific interior designs, prompting producers to offer a huge variety of seat options in terms of materials, colors, and configurations. This fashion is pushed via the choice of individuality and the belief that the car is an extension of the proprietor's persona. In conclusion, the automotive seat marketplace is experiencing dynamic adjustments shaped by evolving patron preferences, technological innovations, and environmental concerns. The enterprise is witnessing a shift towards lightweight substances, smart technologies, and sustainable practices, reflecting the wider developments within the car zone. As electric-powered and autonomous cars become extra familiar, the demand for adaptable and connected seat designs is expected to rise. Manufacturers that effectively navigate and include those marketplace trends are likely to live aggressively inside the unexpectedly evolving automotive seat market.

Leave a Comment