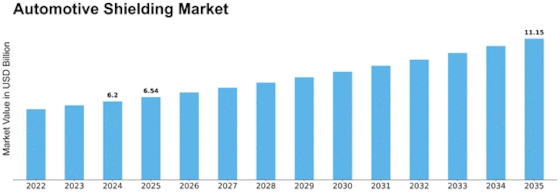

Automotive Shielding Size

Automotive Shielding Market Growth Projections and Opportunities

The demand for automotive shielding devices fluctuates with the growth or contraction of the automobile industry. Protecting sensitive electronic systems from RFID and EMI is becoming more and more important as electronic components in cars are being joined together at an ever-increasing rate. The rise of autonomous driving technologies and the popularity of hybrid and electric vehicles have increased the complexity of automotive hardware. This striking sight spurs advancements in shielding materials and techniques, pushing the industry to grow and adapt to the shifting automobile landscape. The demand for shielding systems is impacted by the concentration of vehicle production in particular regions. For instance, regions like Asia-Pacific, Europe, and North America with a strong automobile manufacturing base have more demand for vehicle protection products. Furthermore, the relevance of market components such as exchange methods, responsibilities, and global considerations in shaping the automotive shielding market is further highlighted by the globalization of the automobile manufacturing network. There is a growing demand for automobiles equipped with state-of-the-art shielding technologies as consumers get more knowledgeable and aware of the potential impact of electromagnetic interference on vehicle hardware. To further stimulate market development, automakers are being urged by customers to integrate cutting-edge shielding systems into their automobiles. Development and ruthless evaluation are fostered by the existence of diverse stakeholders, ranging from established corporations to emerging startups. To stay ahead of the competition, this resistance forces companies to invest in creative projects, which drives constant advancements in shielding technology. A significant role is played by each variable in shaping the market elements, ranging from the overall health of the automotive industry to regulatory policies, technological advancements, and consumer preferences. The demand for state-of-the-art shielding arrangements will only increase as the automobile industry grows, creating a dynamic and continuously changing landscape in the automotive shielding market.

Leave a Comment